Becoming a tax preparer and “hanging up a shingle”, as they say, is one thing. Getting people to trust you to prepare your taxes is another. Sure, your client base will start off with friends and family and their extended network, but if you want to be successful, you’ve got to go beyond that. Establishing […]

Displaying: Recent Posts

4 Things You Need to Support Your Clients Virtually

As we prepare for another tax season during a global pandemic, it’s time to think critically about serving clients safely and conveniently. Last tax season dragged out due to COVID-19 causing a delayed filing deadline and extensions. This year, we face a full tax season with COVID-19. Are you fully equipped and ready for what […]

We Teach – Group Discount – AFSP 18 Hr Non-Exempt Package

FOR NON-EXEMPT PREPARERS n Bundle Includes: n n 6 credit hours AFTR Course n 2 credit hours Ethics n 2 credit hours Income, Expenses, and Basis n 2 credit hours Business Organization n 3 credit hours Tax-Related Investments n 3 credit hours Responding to the IRS n nThis Bundle contains all necessary credits for a […]

We Teach – Group Discount – AFSP 15 Hr Exempt Package

FOR EXEMPT PREPARERS n Bundle Includes: n n 2 credit hours Ethics n 2 credit hours Income, Expenses, and Basis n 2 credit hours Business Organization n 3 credit hours Federal Tax Law Updates n 3 credit hours Tax-Related Investments n 3 credit hours Responding to the IRS n nThis Bundle contains all necessary credits […]

Which Accounting Certification Is Best? – A Review of the Top 5 Certifications

Accounting majors have an array of careers available to them, and specializing by getting an accounting certification opens even more doors. But the big question is: which accounting certification should you go for? Below, we’ll go over the five common accounting certifications to help you decide which one you should choose for your career. 1. […]

Top Tips for Virtual Meetings and Interviews for Accountants

Everybody knows that the face of accounting (and every other industry) has changed with current events. From Zoom conferences to solely digital internships, virtual meetings are taking over, and as that happens – the way you approach them must change, too. It’s no surprise that a virtual internship, or a virtual meeting, can feel a […]

The Benefits of Professional Associations

Starting a tax business requires commitment, dedication, and a lot of self-directed hard work. Professional tax and accounting associations can help. Many associations equip entrepreneurs and business owners with varying resources, articles, advice, and more. The National Association of Tax Professionals (NATP), National Society of Accountants (NSA), and American Institute of Certified Public Accountants (AICPA), […]

How to study for your CPA Exam while working remote

The coronavirus has truly changed the way we go about our everyday lives. Things we never thought about before, like going to the grocery store, going to the gym, and going to work are being changed and restricted at a rapid pace. Many of us are now telecommuting (or working from home) as many businesses, […]

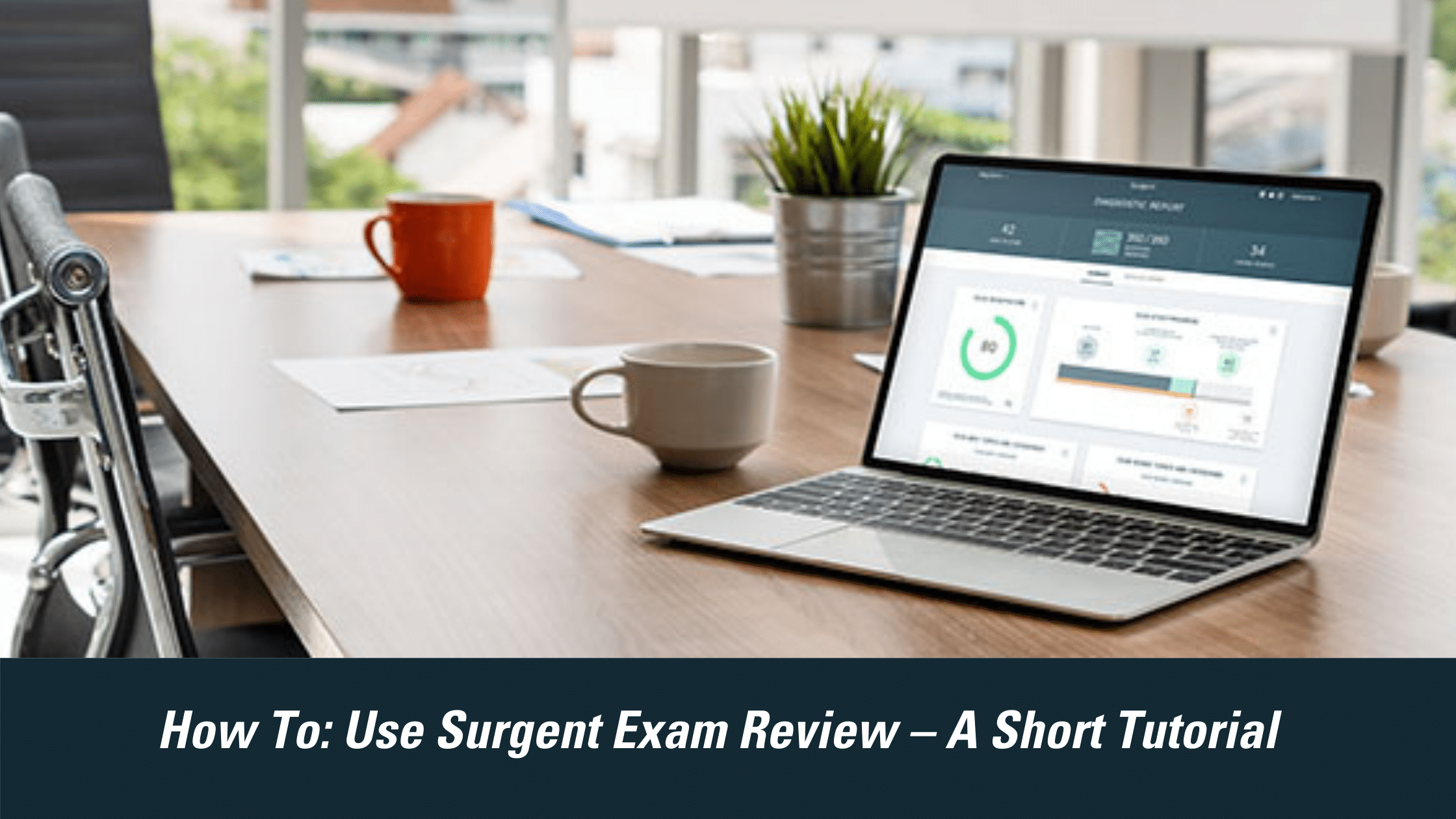

How to Use Surgent Exam Review – A Short Tutorial

Well, if you’re looking at this blog, I think we can all assume that you’re ready to dive into studying with Surgent Exam Review. So firstly – thanks for choosing us! We know that starting to study with a new tool can be tough, regardless of the circumstance – so to help you progress through […]