The following article is a guest blog post by Joy Gendusa of Postcardmania There’s ONE main factor which differentiates successful direct mail tax preparation campaigns from those that flounder and end up being a waste of money. But before I tell you what that is, I want to show you 3 tax practice marketing […]

Displaying: Recent Posts

Are You a Connector?

Have you heard of the philosophy “Givers Gain”? It’s a BNI principle based on the law of reciprocity. Networking should be an important part of your business. It’s a tried and true way to build your network, spread the word about your company, and essentially gain new clients. You’ve likely encountered a number of different […]

Surgent CPA Review: A top pick for 2017’s best CPA review course

Let’s face it! To achieve CPA exam success, you need one incredible review course to power your studies. Most of us know that, but not everybody knows who all the big players are in the CPA review course market and what each of them is known for. That’s why I dive into reviewing each of […]

IRS Tips for Holiday Security

The IRS wants to remind holiday shoppers to remain vigilant with their personal information this holiday season. That means you should be communicating with clients to ensure they stay vigilant this December. In the hustle and bustle of finding the best deals and shopping for everyone on your list, cybercriminals are waiting. While you’re shopping […]

Thankful for Our Family Business

The Income Tax School is a nationwide online tax school that serves thousands of tax professionals and students each year. While that takes an entire team of employees to run, at its core both The Income Tax School and Peoples Tax are a family business. It didn’t start out as a family business, but […]

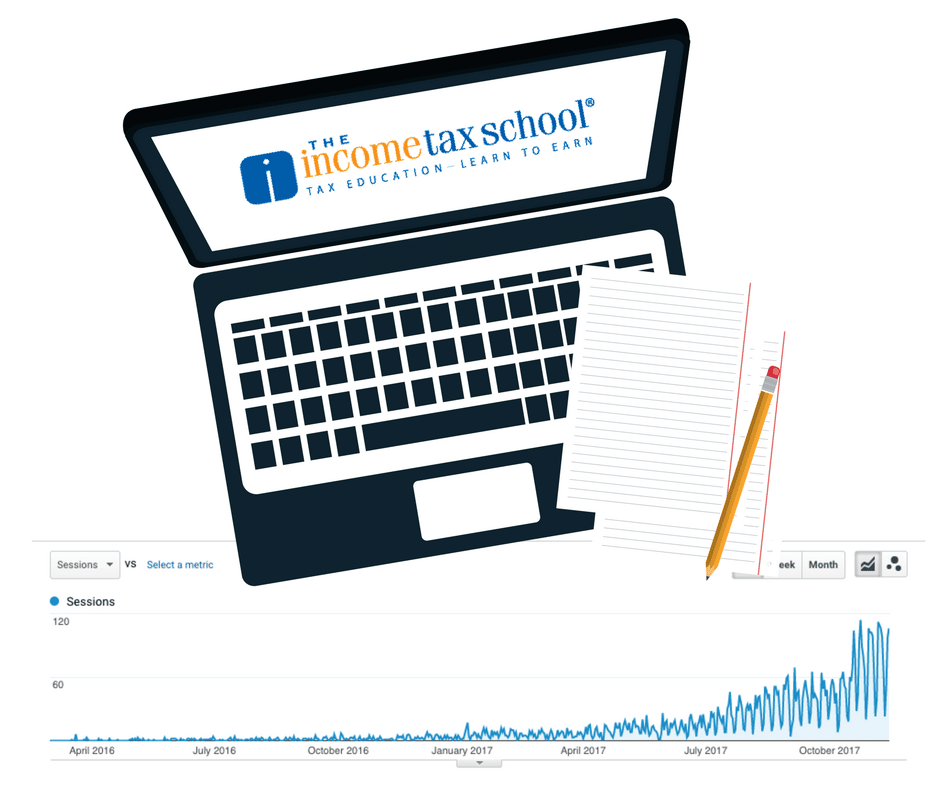

How One Blog Post Generated Thousands of Hits

Last year we wrote a blog post on the Peoples Tax blog (our sister tax preparation company) with line by line explanations on filling out a W4. Each month, no matter what we write about, this blog is the most visited page on our website. In fact, since we posted it in March of […]

What you need to know about CPA Exam changes

The AICPA recently announced 2018 CPA Exam changes. Here’s what you need to know: Blueprints Each exam section’s blueprint link the knowledge and skills to be tested on the exam to tasks that are representative of the work of a newly liscenced CPA. The blueprints are updated perioidcally to include new content that becomes […]

Are You Investing In Your Employees?

Your employees are the heart and soul of your business. They keep your clients happy and they keep operations running. It’s important to make sure that you take care of them. Not only do happy employees make for happy clients, it’s expensive to hire and train. So, keeping your turnover low is extremely advantageous. Here […]

Time to Set Year-End Tax Planning Appointments

The holidays are quickly approaching – which for the tax industry means year-end tax planning should be on your radar. Have you reached out to clients yet? It’s important that both individual and business clients consult with you to make tax moves that could positively affect their tax bill come tax season. Here are some […]