Cybercriminals are targeting a new group lately: tax preparers. Cybercrime has become serious business in the past few years as new, more sophisticated scams crop up. Cybercriminals have realized – why target one tax payer when you can breach an entire tax office or single tax preparer and hundreds of taxpayer identities? Be wary of […]

Displaying: Recent Posts

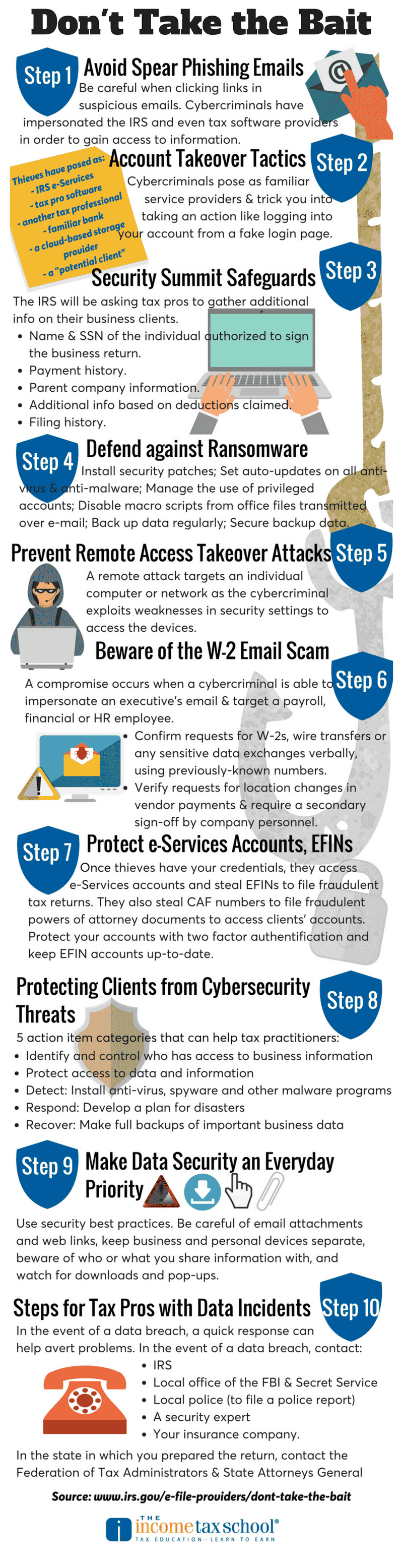

IRS Don’t Take the Bait Recap

Have you been following the IRS Don’t Take the Bait series? This 10-part education series was part of the IRS Security Summit effort. Data breaches and scams have been steadily increasing and are getting more and more sophisticated. The purpose of the series is to raise awareness of this and educate tax preparers on security […]

Adaptive learning: Surgent CPA Review’s ‘secret sauce’

My name is Brandon Vagner, CPA, PhD, former KPMG Manager, and founder of CPA Exam Success and Test Prep Store. I’ve professionally reviewed and analyzed many high quality review courses all the way from GMAT prep courses to CPA review courses. When you boil it down and look at all the factors, what matters most […]

IRS Nationwide Tax Forum Recap

Our team had such a great time this year attending the IRS Nationwide Tax Forums! We were in Orlando, Las Vegas, Dallas, National Harbor, and San Diego meeting with tax preparers and talking about tax education. We love meeting new people, answering questions, and reconnecting with our “Road Family” – people we see year after […]

Digital Access – EA

Free Resources for Tax Preparers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders. That’s why, along with all of the materials and support we provide to students, we also strive to write informational blog posts and other free sources of information. Did you know […]

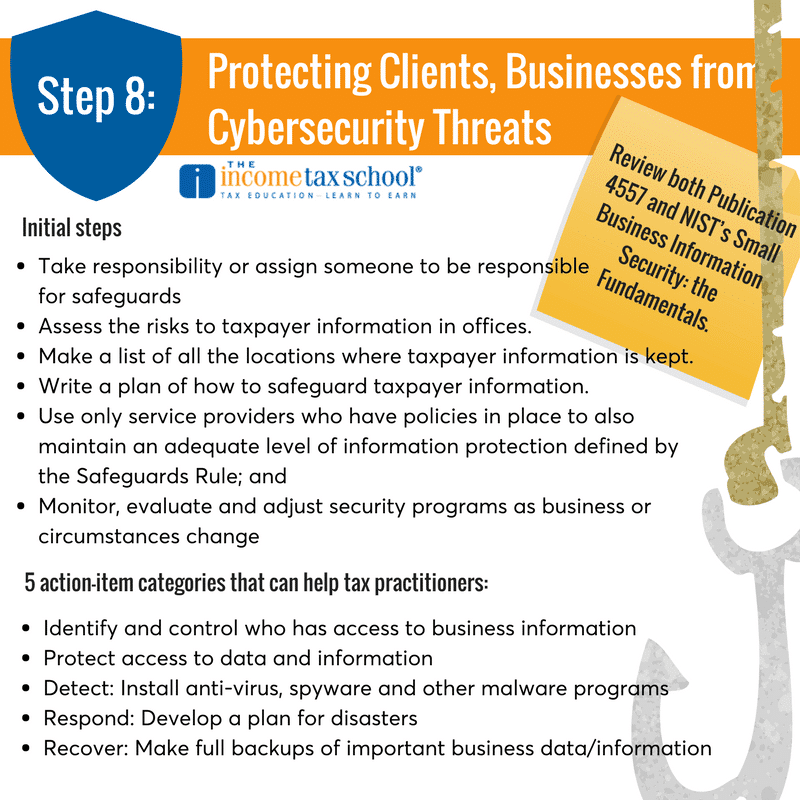

Protect Your Clients From Cybersecurity Threats

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to do so through their Don’t Take the Bait campaign, a 1o part series […]

COSO updates enterprise risk management framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) released the ERM (Enterprise Risk Management) Framework: Enterprise Risk Management–Integrating with Strategy and Performance on September 6, 2017. This is COSO’s first significant update to the original 2004 ERM document, Enterprise Risk Management–Integrated Framework. The provisions of the updated ERM framework become testable on the […]

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could […]