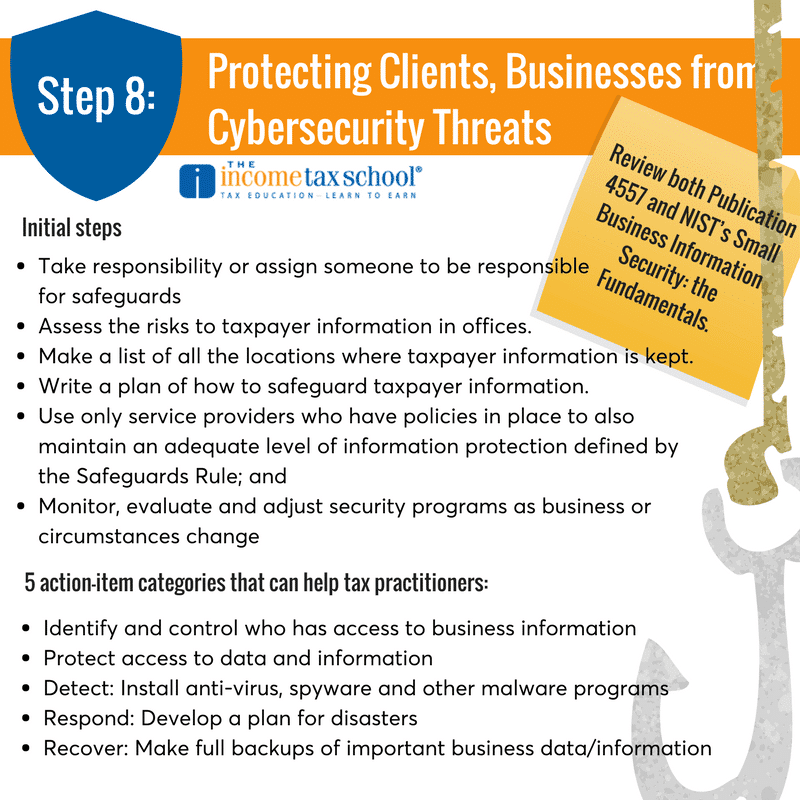

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to do so through their Don’t Take the Bait campaign, a 1o part series […]

Displaying: Recent Posts

COSO updates enterprise risk management framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) released the ERM (Enterprise Risk Management) Framework: Enterprise Risk Management–Integrating with Strategy and Performance on September 6, 2017. This is COSO’s first significant update to the original 2004 ERM document, Enterprise Risk Management–Integrated Framework. The provisions of the updated ERM framework become testable on the […]

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could […]

FASB simplifies accounting for derivatives and hedging instruments

The Financial Accounting Standards Board (FASB) has issued Accounting Standards Update No. 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. The provisions of the new ASU are effective for fiscal years beginning after Dec. 15, 2018. The content becomes testable on the CPA Exam Jan. 1, 2019. ASU No. 2017-12 […]

Introducing: Guide to Start and Grow Your Successful Tax Business

I’m excited to announce the release of my book, Guide to Start and Grow Your Successful Tax Business! This 289-page book is a go-to guide for anyone looking to start or grow a tax business. The guide covers everything from learning tax preparation, to establishing your tax office, marketing and pricing, recruiting and training employees, […]

The Benefits of Guest Blogging for Your Tax Business

Content marketing has become an important part of marketing for every business. Beyond sharing your expertise on your blog or creating white papers for download, there’s another great option – that could help get you in front of fresh eyeballs. It’s called guest blogging. Guest blogging is just what it sounds like. Creating original content […]

AICPA releases standard on exempt offerings

Statement of Auditing Standards (SAS) No. 133, Auditor Involvement With Exempt Offering Documents, was issued July 26, 2017, and provides performance requirements for auditors involved with documents for exempt offerings such as municipal securities; securities issued by not-for-profit religious, education, or charitable organizations; crowdfunding; small issues of securities such as Regulation A offerings; and franchise […]

New Guidelines on Passwords

You know all that advice about making hard passwords? They must include at least one number and special character. You know how we’re told to change the password frequently and to never use the same one for different things? Well, there are new guidelines that basically say to forget what you’ve been told. So, thanks […]

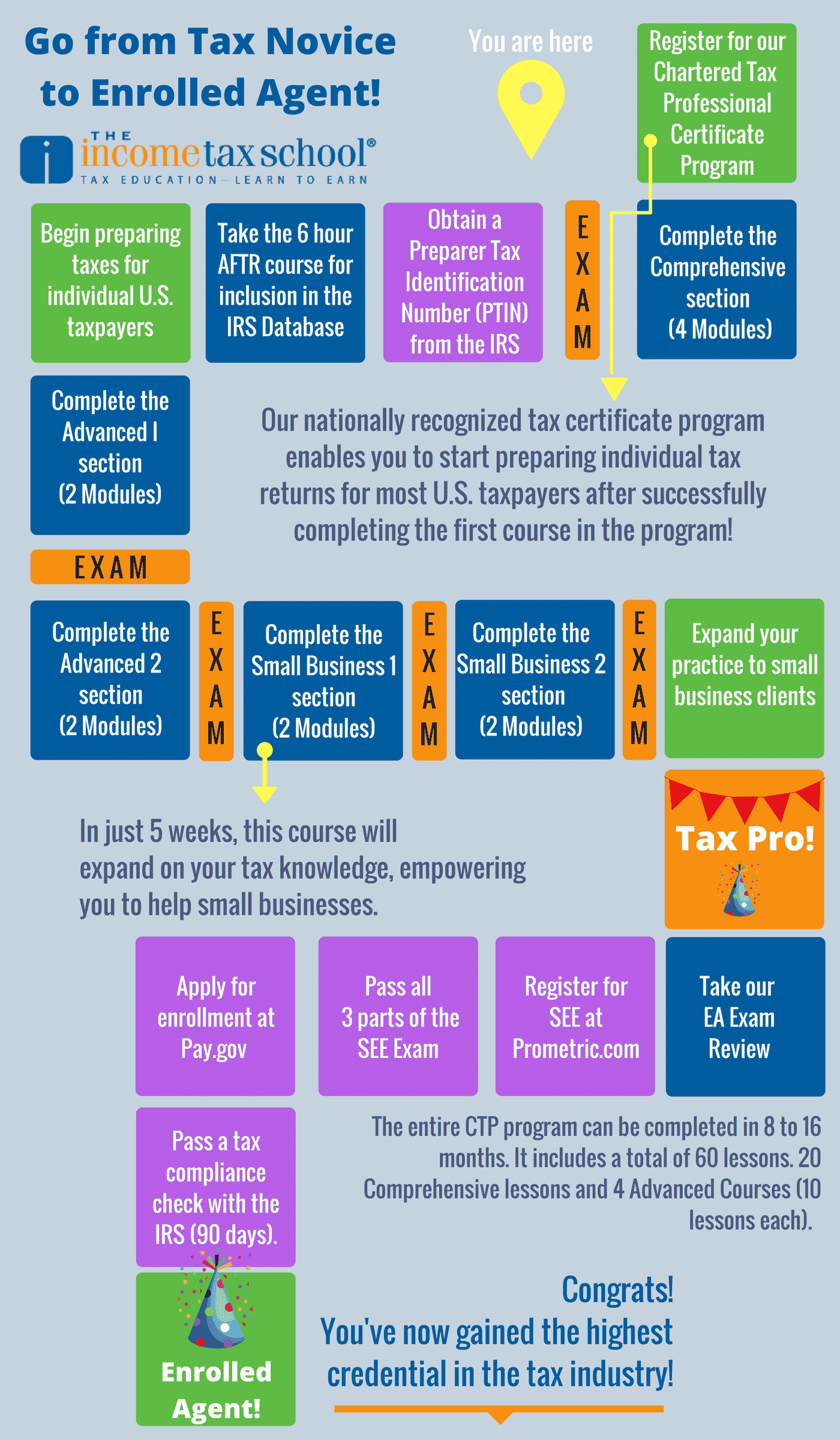

The Path to Enrolled Agent

If you’re looking for a career in the tax industry, set your sights high! While it doesn’t take much to become a tax preparer and start preparing taxes for the general public, earning a credential as an Enrolled Agent should be the ultimate goal. Enrolled Agents are the only credentialed tax preparer and thus have […]