Are you making the most of the off season? Trying to think of ways that you can? Beyond offering additional services, you could also run your own tax school. We’ve found it to be a great business model. In fact, it’s how The Income Tax School got started! Here are six reasons to operate your […]

Displaying: Recent Posts

Video: Students well prepared for CPA Exam with Surgent CPA Review

If you took the 2017 CPA Exam, how well did your CPA Review course prepare you? Students are saying they were well prepared with Surgent CPA Review! Watch two video testimonials.

Tip of the month: Surviving the CPA Exam as a professional

Because studying for the CPA Exam is already challenging enough, studying while working full-time can seem impossible. We spoke with Adam Borrelli, CPA, a Partner at RSM in Philadelphia. Here are his recommendations for passing the CPA Exam as a professional!

PCAOB addresses critical audit matters in new standard

The PCAOB addressed critical audit matters in a new standard. Parts of this standard are testable on the CPA Exam in the first quarter of 2018.

4 Stories Every Tax Preparer Should Be Paying Attention To

There’s been a bit of a shake up in the tax industry the past couple of weeks! Lots of changes are being made (or trying to be made) that could have serious impacts on our roles as tax preparers and tax business owners. Here are 4 stories you should be aware of and following closely. PTIN Fees […]

Would You Take the Bait? Why Phishing Scams Should Concern You

Who really falls for a phishing scam? It’s probably a question you’ve asked yourself or said to a friend or colleague. People fall for phishing scams all the time, it’s why they continue to happen. Sure, there are a lot of “Nigerian Prince” emails that get sent. These are the most obvious and well known […]

The hidden truth: CPA review payment plans

Many of the leading CPA Review course providers offer payment plans as a means of payment for a full 4-part CPA Review course. But did you know that many of these plans have hidden fees? Read more to discover the true financial cost to candidates.

4 Reasons to Focus on Complicated Returns Next Tax Season

This Summer is a great time to evaluate the tax season and make a plan for next season. Beyond staffing and process improvements you should be looking at the services you offer and what you plan to offer or focus on next season. We’ve been watching the industry and the news closely and have 4 reasons why […]

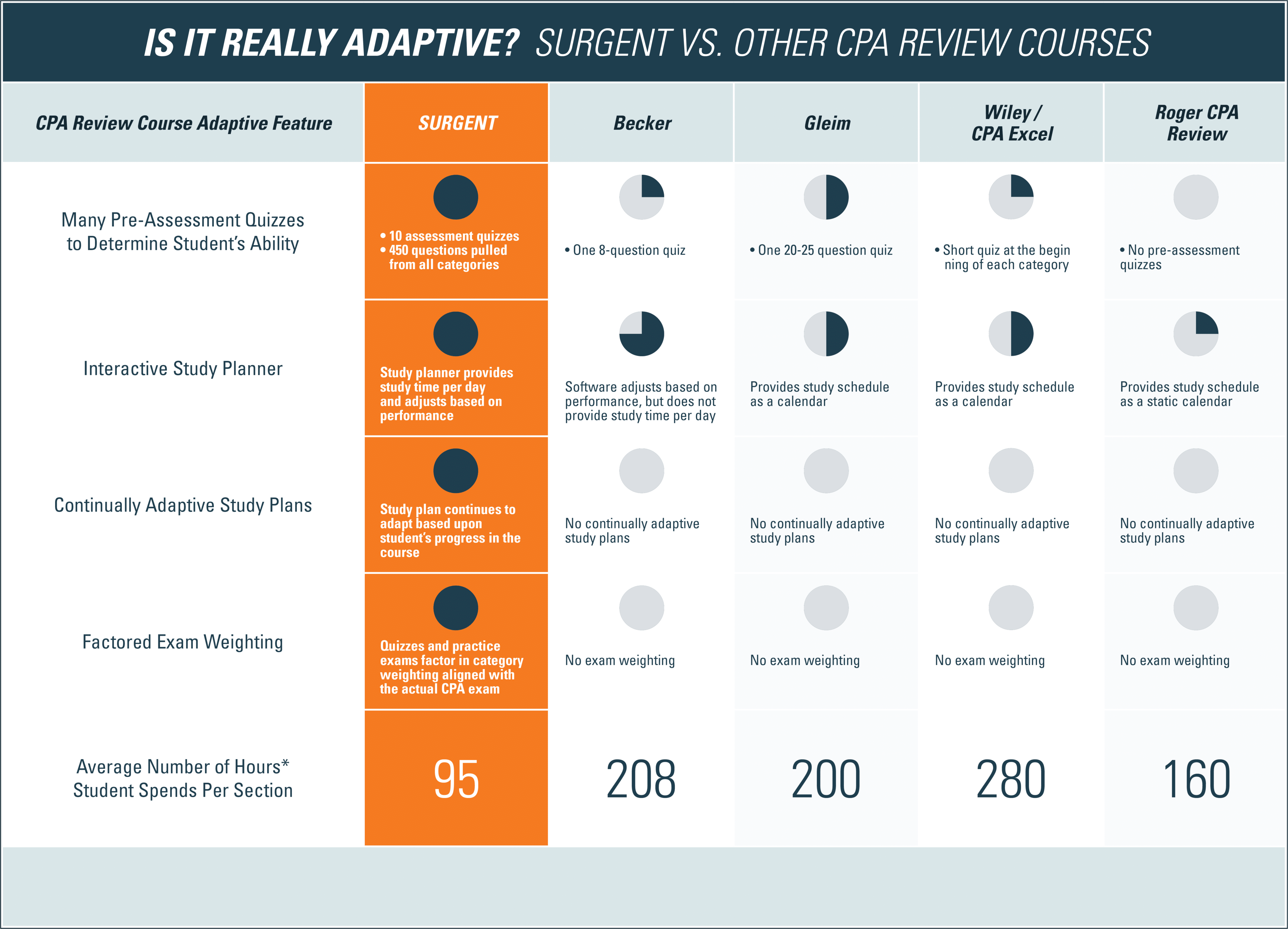

The hidden truth: Adaptive technology and CPA review courses

Several leading providers, including Becker CPA Review, Gleim, and Wiley, claim to be adaptive, but are they really? Measuring features critical to adaptive learning technology, we examined several leading providers to uncover the hidden truth.