The IRS takes due-diligence requirements very seriously. In fact, in order to prepare for the upcoming season this year, they sent letters to paid tax preparers whom they suspected were noncompliant in meeting their Earned Income Tax Credit (EITC) due-diligence requirements. According to The Journal of Accountancy, the IRS estimates that between 22% and 26% […]

Displaying: Recent Posts

Essential Tax Office Training Check List

As the end of the year creeps up on us and the holiday parties pile up, it’s necessary to remain focused on preparing yourself, your tax office, and your employees for the upcoming tax season. If you’ve hired new tax preparers, training them is of utmost importance. On-boarding new preparers and training them on customer service […]

Surgent CPA Review receives No. 1 ranking on CPA Exam Hub

DEVON, PA (PRWEB) – Surgent CPA Review, a comprehensive CPA Exam prep program that guarantees participants will pass the CPA Exam the first time, received a #1 ranking from CPA Exam Hub, a CPA Exam comparison site. Surgent ranked higher than the other 21 programs evaluated in all but 2 ranking factors, receiving a No. […]

Important Items to Secure Before Tax Season

Are you ready for the upcoming season? If you haven’t renewed your PTIN then the answer is no. Anyone who prepares or helps prepare federal tax returns for compensation must have a valid Preparer Tax Identification Number (PTIN) from the IRS. The PTIN is an identifying number for a specific tax preparer on returns prepared. […]

Expressing Our Thanks this Thanksgiving

Thanksgiving is a time for family, comfort food, and feeling thankful for the things we have and the people we love. Here at The Income Tax School we are thankful for our students, our amazing instructors, our hard working employees, our many partners, and the great organizations we are involved with. Here’s what some of our […]

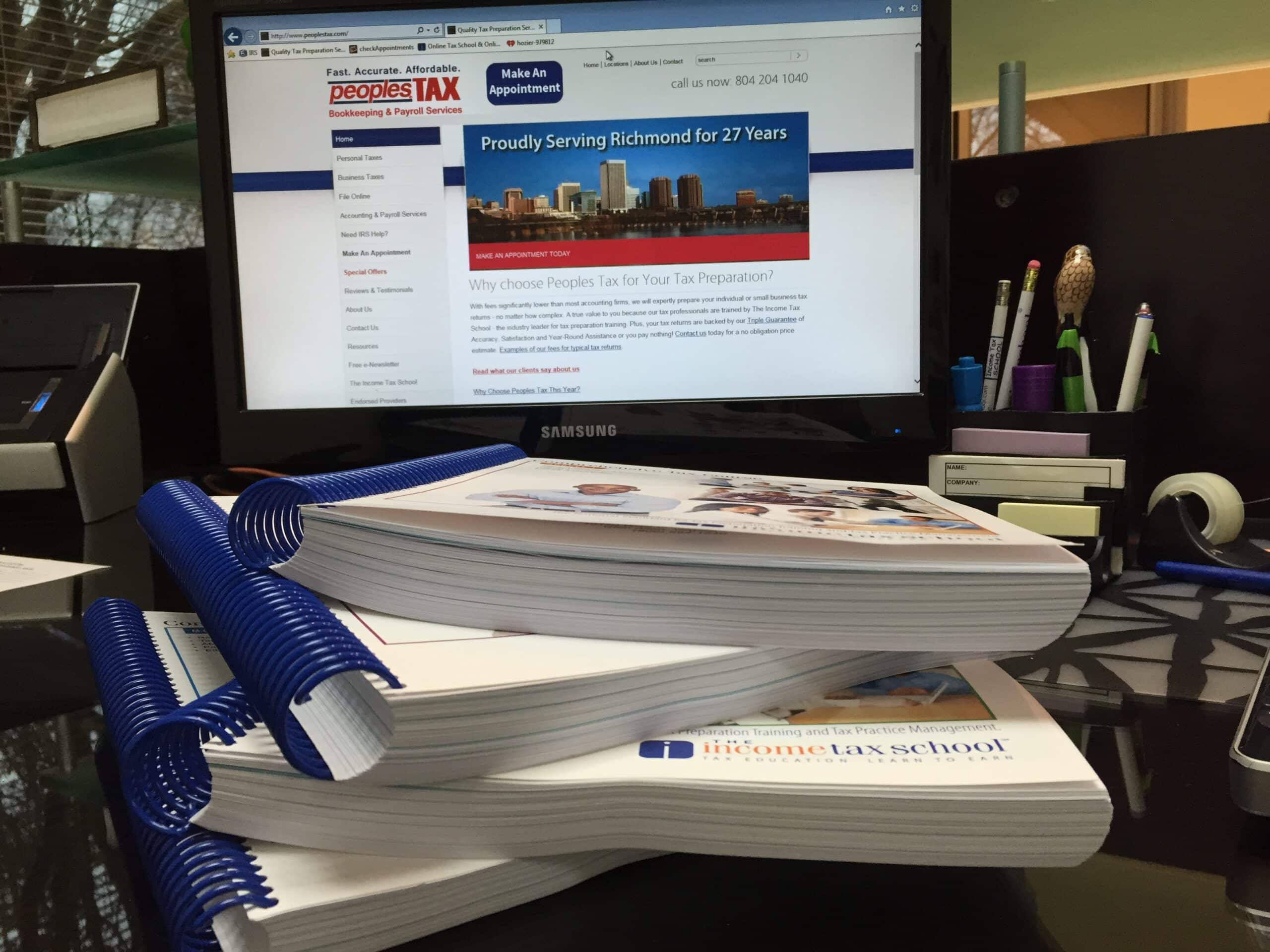

6 Reasons Why Education on IRS Tax Code Is Essential

Relying on tax software is a slippery slope – one that tax preparers should not fall for. Sure it’s convenient, but nothing can replace a deep knowledge of tax law. The tax law is extremely complicated and there is a lot to know. So much so that the stack of books to the right are […]

ASU 2016-18 Statement of Cash Flows will be CPA Exam testable January 2018

On November 17, 2016, the FASB issued Accounting Standards Update No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash.

5 Ways to Increase Conversions on Your Website

Your website is a major marketing tool that, if set-up properly can produce calls, walk-ins, appointments, newsletter sign-ups, or really anything your business needs. Setting up a website is one thing. Getting it to convert visitors into clients or newsletter subscribers is something else. So what, specifically, is a website conversion? A conversion rate equals the […]

2016 Presidential Candidate Tax Plans

In less than one week, Americans will vote for our next President. While we won’t make a political endorsement or take a stance on any candidate running, we think it’s important to know the tax plans of both candidates and more importantly, to inform your clients about them. If you are unsure how to communicate this […]