As tax season marches on, how are you reaching new clients? Are you promoting in the all the right places? Do you have an enticing offer to get them to try your business? Here are three ideas to help drive traffic through your door. Offer up Gift Certificates at events and auctions Finding time to […]

Displaying: Recent Posts

Upcoming changes to FAR section of CPA Exam

Surgent CPA Review has summarized the Financial Accounting and Reporting standards that will become testable in Q2 2016.

How to Qualify For A Deduction Under Work Related Education

Chances are, if you are reading this blog you are either a tax preparer who has taken continuing education courses, a tax preparer who has just completed their tax education, or a tax student. Either way, it’s tax time, and the question you are likely wondering is whether your tax education is deductible. While tax […]

Are You Putting Your Marketing Dollars In The Right Places?

When I think about all of the avenues of advertising a business has to choose from, two quotes come to mind. “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” – John Wanamaker “A man who stops advertising to save money, is like a man who stops a […]

4 Ways to Optimize Your Print Mailers This Tax Season

Thanks to email and the Internet, tax businesses in general do a lot less print mail than they used to. Even so, print mail is making a bit of a comeback and many tax firms still use it to drive business during tax season. People get so many emails these days and many go straight to junk […]

Transitioning to new Revenue Recognition Standards

In a recent poll, many companies said they have not yet attempted to quantify the financial statement impact of the new revenue recognition standard.

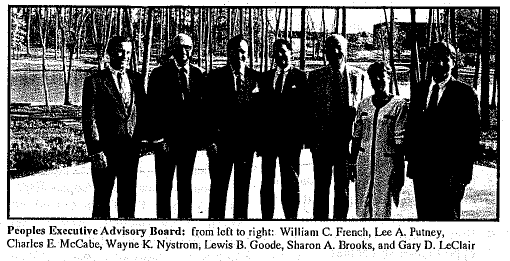

Grow Your Company With An Advisory Board

“No man is an island; entire of himself…” This famous line written in 1624 by English poet John Donne is still sage advice for anyone, especially an entrepreneur. If you’re satisfied being an independent contractor compensated directly in proportion to your personal services rendered, you won’t need a board. But if you want to build […]

Don’t Miss This Crucial Step In Gaining Your Record Of Completion

If you’re currently trying to gain your IRS Record of Completion, the IRS wants to make sure you don’t miss a step. Have you completed the requirements of the AFTR program? Did you completed the required continuing education by Dec. 31, 2015? Have you renewed your PTIN? How about signed the Circular 2030 consent? According to a […]

New Lease Accounting Standard IFRS 16 testable on CPA Exam October 2019

On January 13, 2016, the International Accounting Standards Board (IASB) issued International Financial Reporting Standard (IFRS) 16, Leases. This will be testable on the CPA Exam beginning in October 2019.