Tax season is right around the corner, and if you’re a tax student you’re likely wondering whether or not your education is going to be deductible. We get this question a lot so we thought we’d address it in a blog post! For students who attend a University, education credits or tuition and fees deductions […]

Displaying: Recent Posts

AICPA announcs CPA Exam is changing earlier than expected

While the AICPA recently announced sweeping changes to the CPA Exam starting in 2017, they just announced that some of those changes could come in 2016!

FAR change alerts for Quarter 1 2016

Surgent CPA Review has summarized the Financial Accounting and Reporting standards that will become testable in quarter 1 of 2016.

Pre-Tax Season Update

The Income Tax School partnered with Accounting Today recently to hold a Pre-Tax Season Update webinar for tax preparers looking to ready themselves for the end of the year and the upcoming season. In case you missed it, here are our presentation slides as well as some notes from the presentation. 2015 Pre-Tax Season Update from Chuck McCabe […]

Watch: AccountingFly interviews Jack Surgent about Surgent and competition

Jeff Phillips from AccountingFly.com interviewed Jack Surgent and discussed the Surgent CPA Review course, what makes it stand out from the competition.

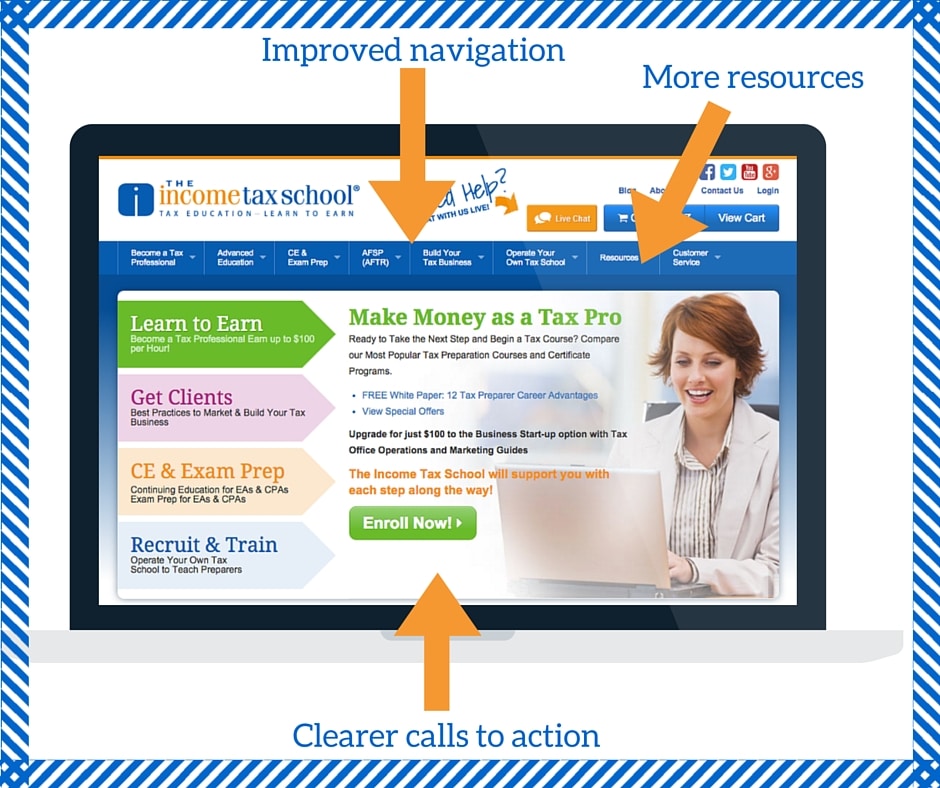

How User Friendly Is Your Website?

Have you been poking around on The Income Tax School website lately? We unveiled a revamped website just before Thanksgiving to help guide our current and potential students to the information they need. Our new website is more user-friendly and we’re excited to tell you why! The user experience is very important. Sometimes it makes […]

SAS No. 130, Audit of Internal Control Over Financial Reporting Update

As part of its Attestation Clarity Project, the Auditing Standards Board (ASB) has issued Statement on Auditing Standards (SAS) No. 130 - including several key changes.

CPA Exam 2017 and Bloom’s Taxonomy

What is the new, overhauled CPA exam going to look like in 2017? If you read the AICPA’s exposure draft, you’ll learn that the AICPA wants to follow what academicians follow: Bloom’s Taxonomy, which is a sort of “stair step” in the learning process.

ASU 2015-17 Income Taxes Update will be testable on CPA Exam in January 2017

The Financial Accounting Standards Board (FASB) has issued Accounting Standards Update (ASU) 2015-17, Income Taxes (Topic 740). This will be testable on the CPA Exam beginning in January 2017.