On July 4 of this year, the President signed the One Big Beautiful Bill Act (OBBBA) into law. Beginning in July 2026, key provisions of OBBBA will be incorporated into the REG and TCP sections of the CPA Exam, making it essential for candidates to understand the law’s content and implications. The largest 2026 CPA […]

Displaying: Higher Education

5 Pioneering Black Figures in the Finance and Accounting Industries

February is Black History Month, a time to bring awareness to the many contributions Black Americans have made throughout our history despite institution and overt racism among other barriers. Here are five Black figures from history who paved the way for other Black Americans to pursue careers in finance and accounting. Madam C. J. Walker […]

Career Paths for CPAs Beyond Public Accounting

Embarking on a career as a certified public accountant (CPA) often begins with visions of a traditional path in public accounting. While public accounting can offer valuable experience, it’s essential for college accounting and finance students and early career accountants to know that alternative career paths exist, providing diverse opportunities to leverage their CPA designation. […]

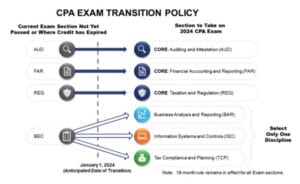

Transition Policy Lets Candidates Keep Passed CPA Exam Sections

We have great news as you enter the CPA exam journey! NASBA approved an amendment to the UAA, allowing state boards to extend the CPA Exam pass window from 18 months to up to 30 months, giving candidates up to an extra 12 months to pass all four parts once they pass their first section. […]

Decoding the CPA Exam: Your Final Blueprint for Success

Everything evolves, and that includes the CPA Exam. As AICPA discovered in recent years, the exam hadn’t kept pace with the needs of accounting firms. They were hiring fewer accountants and more people skilled in data analytics, IT and cybersecurity. The discovery prompted AICPA and NASBA to develop the CPA Evolution licensure model, a revision […]

Facts vs. Myths about the CPA Exam

The CPA exam has evolved. At Surgent, we aim is to cover topics that are becoming increasingly important in the accounting and finance world and better prepare new CPAs for this evolving career landscape. There are a few myths and updated facts circulating online about the newest CPA exam, so let’s set the record straight! […]

How Academics and Educators Can Bridge the CPA exam Knowledge Gap

The newest CPA exam model launched in January 2024, transforming the licensure exam from four core components (AUD, FAR, BEC and REG) to three core components (AUD, REG and FAR; with technology and digital acumen incorporated into each) and a candidate-chosen discipline for the fourth section. The candidates’ options are Business Analysis and Reporting (BAR), […]

Crafting your CPA Exam Strategy

In January 2024, the most recent update to the CPA Exam went into effect. The current format brings additional and increasingly significant financial subjects into the examination with the aim of better preparing CPAs for their role. What you need to know about CPA Exam changes The current CPA exam contains the following parts: Each section […]

Get a boost with CPA Review’s visual learning features

Every CPA review course tends to advertise the same selling points – smart/adaptive learning technology, coaching, video content, textbooks and flashcards… the list goes on. Rather than comparing prices and basic features, try finding a course that matches your learning style. Ultimately, finding a course that helps you process information the best can help […]

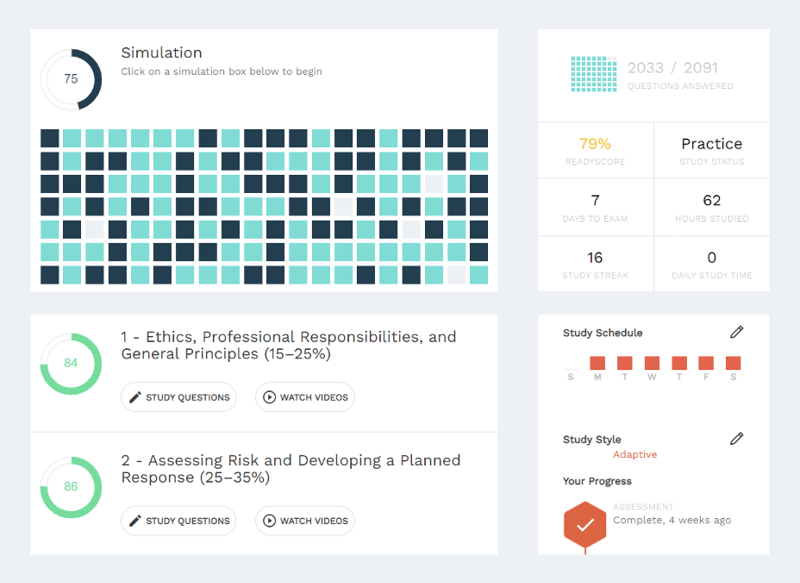

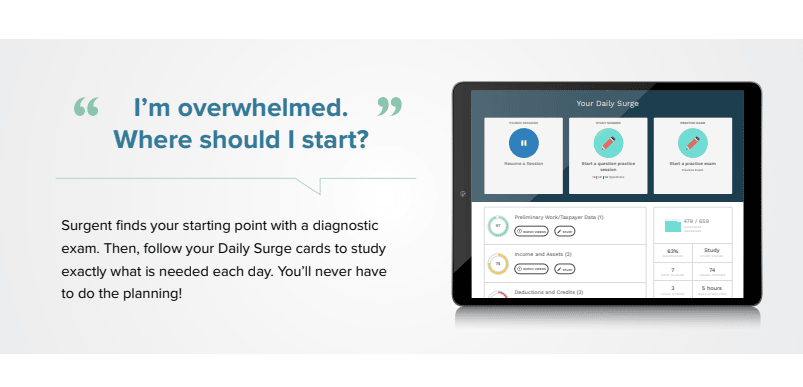

Four ways Surgent can help you pass the CPA Exam

Surgent simplifies studying for the CPA Exam so you don’t have to put your life on pause. Save time, reduce hassle and increase your odds of passing on the first try. Here’s how Surgent can help you. “I’m overwhelmed. Where should I start?” Surgent finds your personalized starting point with a diagnostic exam. From there, […]