Everything evolves, and that includes the CPA Exam. As AICPA discovered in recent years, the exam hadn’t kept pace with the needs of accounting firms. They were hiring fewer accountants and more people skilled in data analytics, IT and cybersecurity.

The discovery prompted AICPA and NASBA to develop the CPA Evolution licensure model, a revision of the CPA Exam to reflect the needs of employers and clients. The AICPA’s new blueprint prepares exam candidates for a restructured exam that recognizes the array of skills in demand in today’s accounting landscape.

Will you be ready? Consider how the blueprint updates the CPA Exam sections and content presented here and plot your path to CPA Exam success.

A look at CPA Exam changes

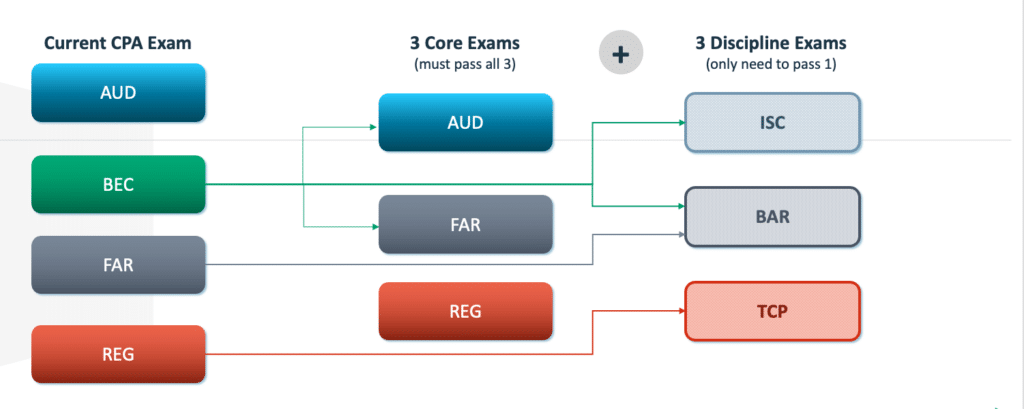

There’s a lot to digest with the CPA exam. Only one discipline is required with the purpose of building a strong foundation for future-accountants to excel in highly valued specialties.

Let’s take a closer look to what’s called the “Core plus Discipline” model:

Note these important items:

- If you passed FAR, REG, or AUD already, you will not need to retake the core section

- If you passed BEC and your credit is unexpired on January 1, 2024, you will not need to take a discipline! BEC is your discipline.

- If you fail a discipline section, you can switch to a different discipline if you think it’s a better option for you.

What are the discipline sections?

The core FAR, AUD and REG sections will continue to test your knowledge of the universal principles of accounting. The former Business Environment and Concepts core exam will now disappear, replaced by the discipline sections that probe more deeply into:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Read below for the content incorporated into each discipline section.

What is BAR?

Business Analysis and Reporting (BAR) will cover assurance or advisory services, financial statement analysis and reporting, technical accounting, financial and operations management. It’s expected that more than 50% of students will take the BAR discipline exam.

Major content:

- Non-financial performance

- Capital structure and operations

- COSO enterprise risk management and its application to ESG

- Managerial accounting and cost accounting

- Variance analysis

- Leases

- State and local government and NFP accounting

- Derivatives and hedge accounting returns

- Consolidation and business combinations

- Revenue recognition application and analysis

What is ISC?

Information Systems Control (ISC) measures your technological expertise, covering business processes, information security and governance, information systems and IT audit.

Major content:

- Information systems and data management

- Security, confidentiality, and privacy

- Considerations for System and Organization Controls (SOC) engagements

- Deeper level of understanding of IT than was covered in BEC

- Regulations, standards, and frameworks

- COSO frameworks applied to cloud computing, blockchain and cybersecurity

- Change management

- Security risks and controls

What is TCP?

Tax Compliance and Planning (TCP) will cover individual tax compliance and planning, personal finance planning, entity tax compliance and planning.

Major content:

- Tax compliance

- Personal finance planning

- Entity tax compliance

- Entity tax planning

- Property transactions

- Formation and liquidation of entities

- Use of losses by taxpayers to minimize tax liability

- Tax implications of foreign income

- Computation of income and deductions for a trust

5 key takeaways about CPA Evolution

Chances are, you still have questions about CPA Evolution. These top five takeaways put the changes in perspective:

1. Parts passed before January 1, 2024 will still count towards licensure

- Any candidate with Uniform CPA Examination credit(s) on January 1, 2024 will have such credit(s) extended to June 30, 2025.

- If BEC is passed before 2024 then BEC will replace the discipline sections.

- FAR, REG, and AUD will carry over and serve as core credit.

2. The 18-month passing window remains in effect.

- Will “refresh” anew on January 1, 2024.

3. The discipline does not need to be your field of study.

- Students may change discipline at any point.

- Each discipline confers the same practice rights as the other disciplines.

- Disciplines can be taken before the core (but shouldn’t be)

- Technology, digital acumen, and data analytics are a core component across all 6 section-parts.

4. Take your discipline immediately after the core section associated with it, which means:

- FAR > BAR

- AUD > ISC

- REG > TCP

5. Account for blackout dates.

Discipline exams can only be taken in certain months, so make sure you plan ahead. Here are the tentative testing windows for core and discipline sections under the CPA Exam model:

- Q1 testing window for discipline sections: Jan. 10-Feb. 6

- Q2 testing window for discipline sections: April 20-May 19

- Q3 testing window for discipline sections: July 1-July 31

- Q4 testing window for discipline sections: Oct. 1-Oct. 31

- Q1 testing window for core sections: Jan. 10-March 26

- Q2 testing window for core sections: April 1-June 25

- Q3 testing window for core sections: July 1-Sept. 25

- Q4 testing window for core sections: Oct. 1-Dec. 26

The Surgent difference gives you an edge

Surgent CPA Review can help you succeed in your CPA exam journey with our proprietary, AI learning system. Surgent combines high-tech and personalized service to streamline the study process for you. Surgent can help improve your chances of passing with less study time needed.

Surgent CPA Review can help you succeed in your CPA exam journey with our Predictive AI Technology.

Consider the many advantages that Surgent offers:

- Predictive AI Technology: Surgent’s state-of-the-art adaptive learning technology that assesses your existing knowledge and identifies what you need to learn, saving you time and helping you reach exam day faster.

- ReadySCORE™: Feel confident on taking the exam, at the right time. ReadySCORE predicts – with 98% accuracy for the CPA exam– the score you would likely receive, if you sat for the test that same day.

- Efficient Studying: By making the most of your study time, CPA Review keeps you focused by recommending the topics you need to cover, every time you dedicate time to study.

- Personalization: Surgent customizes multiple-choice practice questions to test your knowledge and prompt you to learn more challenging concepts with each study session.

- Full access until you pass: Surgent CPA Review materials, including free content and software updates, are available until you pass! *Applies to the Premier and Ultimate packages only.

- Unlimited practice exams: Testing anxiety can keep candidates from doing their best. By having access to unlimited practice exams, included in every Surgent package, can help calm the nerves and leave you feeling extra confident in your abillities.

- 100% pass guarantee: Surgent’s systematic, technology-driven supports greatly improve your chances of passing the CPA Exam. However, if something goes wrong, Surgent’s pass guarantee means you don’t lose your prep course investment. *Applies to the Premier and Ultimate packages only.

Seize the opportunity

The CPA exam has evolved, bringing the accounting profession into the 21st century. Surgent’s exam preparation personalizes each individual’s journey in an engaging way. Simply enter your exam date, and the software will automatically provide you with the AICPA blueprint content you need to study. Surgent continually rolls out updates to its exam prep courses, with material that changes dynamically based on your testing date. Surgent CPA Review tailors CPA exam prep to your needs, strengths, experience, and goals.

Surgent makes it as easy as possible to study the correct material, so you won’t be backtracking or wading through irrelevant material. In order to stay on top of the latest updates regarding the CPA exam, Surgent will support and guide you through it all as you prepare to pass the CPA exam.

Stay in the loop

Sign up today for can’t-miss industry updates, exam changes, and exclusive study tips from our expert blog.