In January 2024, the most recent update to the CPA Exam went into effect. The current format brings additional and increasingly significant financial subjects into the examination with the aim of better preparing CPAs for their role.

What you need to know about CPA Exam changes

The current CPA exam contains the following parts:

- AUD (Auditing and Attestation)

- FAR (Financial Accounting and Reporting)

- REG (Regulation)

- BAR (Business Analysis and Reporting)

- ISC (Information Systems and Controls)

- TCP (Tax Compliance and Planning)

Each section takes four hours, for a total of 16 hours to complete the requirements for the CPA Exam.

Format changes

The CPA exam format has evolved. Candidates are responsible for passing three core sections and one new discipline section. Everyone who sits for the CPA exam will still need to pass the AUD, FAR and REG sections; however, they have three options when it comes to the discipline section:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

While the three core sections reflect general knowledge all CPAs should have, the discipline exams focus on specialties. Below is a quick breakdown of the main topics that will appear in the three new discipline sections.

Business Analysis and Reporting (BAR)

- Capital structure and operations

- Consolidation and business combinations

- Derivatives and hedge accounting returns

- Leases

- Managerial accounting

- Non-financial performance

- State and local government and NFP accounting

- Revenue recognition application and analysis

Information Systems and Controls (ISC)

- Change management

- Considerations for System and Organization Controls (SOC) engagements

- COSO frameworks applied to cloud computing, blockchain and cybersecurity

- Information systems and data management

- Regulations, standards and frameworks

- Security, confidentiality and privacy

- Security risks and controls

Tax Compliance and Planning (TCP)

- Computation of income and deductions for a trust

- Formation and liquidation of entities

- Entity tax compliance

- Entity tax planning

- Personal finance planning

- Property transactions

- Tax compliance

- Tax implications of foreign income

- Use of losses by taxpayers to minimize tax liability

Content changes

In addition to the overall format change, some exam content has moved to other sections. For example, content from the former BEC section is broken up and added to four of the six sections. Also, “Understanding and applying financial statement ratios and performance metrics” moved to the FAR section, and “Basic economic concepts – supply and demand, business cycles” and “Business process and internal controls” fall under the AUD section.

Also, certain topics within each section have moved from the core exam into one of the new discipline exams. And now some FAR content is was split between the FAR core exam section and the BAR discipline section. These include the following:

- Analysis skill level representative tasks for revenue recognition

- Business combinations

- Consolidated financial statements

- Derivatives and hedge accounting

- Financial statements of employee benefit plans

- Government accounting

- Indefinite lived intangible assets

- Internally developed software

- Leases

- Public company reporting

- R&D costs

- Stock compensation

Some REG topics, specifically gross income concepts (ISO, imputed interested, compensation earned outside the U.S.), moved to the TCP discipline exam.

Key dates related to the CPA exam

Any exam sections passed before January 1, 2024, will still count toward licensure. You will not need to retest in 2024. AUD, FAR and REG exams will count as core credit, and BEC will replace a discipline section requirement.

The 18-month passing window will stay in effect; however, any section passed in 2023, that clock reset on January 1, 2024, so you’ll get extra time to finish all exams. In fact, if you passed any section after July 1, 2022, you would have until June 30, 2025, to pass your remaining sections.

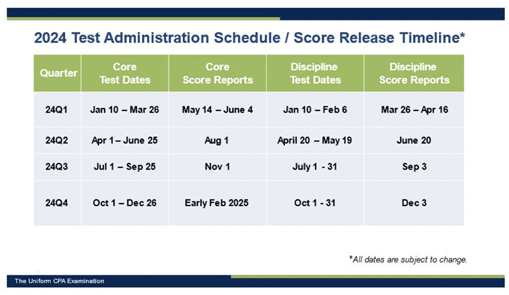

The AICPA has released a tentative schedule of testing and score reporting dates for 2024 to help you plan your exam strategy.

Stay in the loop

Sign up today for can’t-miss industry updates, exam changes, and exclusive study tips from our expert blog.