If you’re currently trying to gain your IRS Record of Completion, the IRS wants to make sure you don’t miss a step. Have you completed the requirements of the AFTR program? Did you completed the required continuing education by Dec. 31, 2015? Have you renewed your PTIN? How about signed the Circular 2030 consent? According to a […]

Displaying: Income Tax School

What’s In Store For The 2016 Tax Season? Get The Scoop

What’s in store for the 2016 tax season? While we don’t have a crystal ball that sees into the future, we have been following IRS updates, tax industry news, and other sources that can paint a pretty good picture of what tax professionals will face this tax season. Here are some things to expect. The […]

5 New Year’s Resolutions To Make Your Tax Season The Best One Yet

It’s almost that time… No not the new year, tax time! Hopefully you’ve all had a restful, relaxing holiday season and are ready for the start of the tax season. Don’t leave your New Year’s resolutions to personal growth, make some for professional growth as well! Here are some resolutions (more like action items) to […]

An Easy, Low-Cost Fast-Track to Entrepreneurship

Are you a people person? Do you aim to please? Do you find that you excel at customer service? If you answered yes to any of those questions, then you’re qualified to become a tax preparer. Tax preparation isn’t all about numbers – it’s about helping people during tax time. As a tax preparer, you […]

Is Tax Education Deductible?

Tax season is right around the corner, and if you’re a tax student you’re likely wondering whether or not your education is going to be deductible. We get this question a lot so we thought we’d address it in a blog post! For students who attend a University, education credits or tuition and fees deductions […]

Pre-Tax Season Update

The Income Tax School partnered with Accounting Today recently to hold a Pre-Tax Season Update webinar for tax preparers looking to ready themselves for the end of the year and the upcoming season. In case you missed it, here are our presentation slides as well as some notes from the presentation. 2015 Pre-Tax Season Update from Chuck McCabe […]

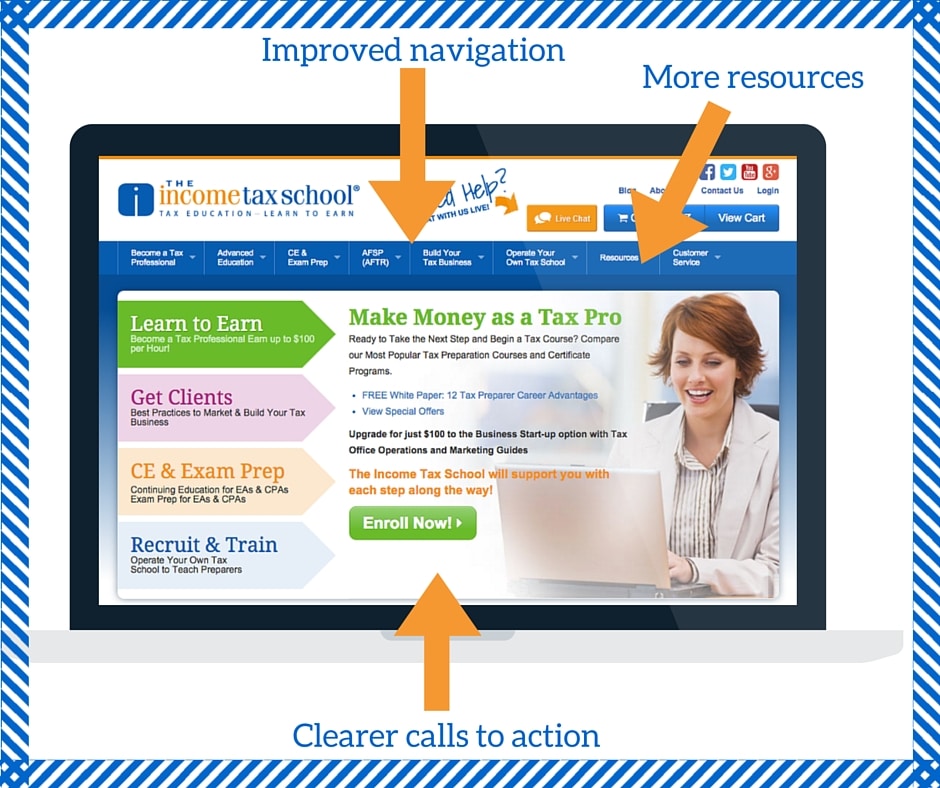

How User Friendly Is Your Website?

Have you been poking around on The Income Tax School website lately? We unveiled a revamped website just before Thanksgiving to help guide our current and potential students to the information they need. Our new website is more user-friendly and we’re excited to tell you why! The user experience is very important. Sometimes it makes […]

What Are You Thankful For?

It’s that time of year when we gorge on delicious foods, gather with family and try not to think about taxes or the upcoming tax season. This is the time of year that we look inward and think about the things that we are thankful for. We asked our staff to tell us what they’re […]

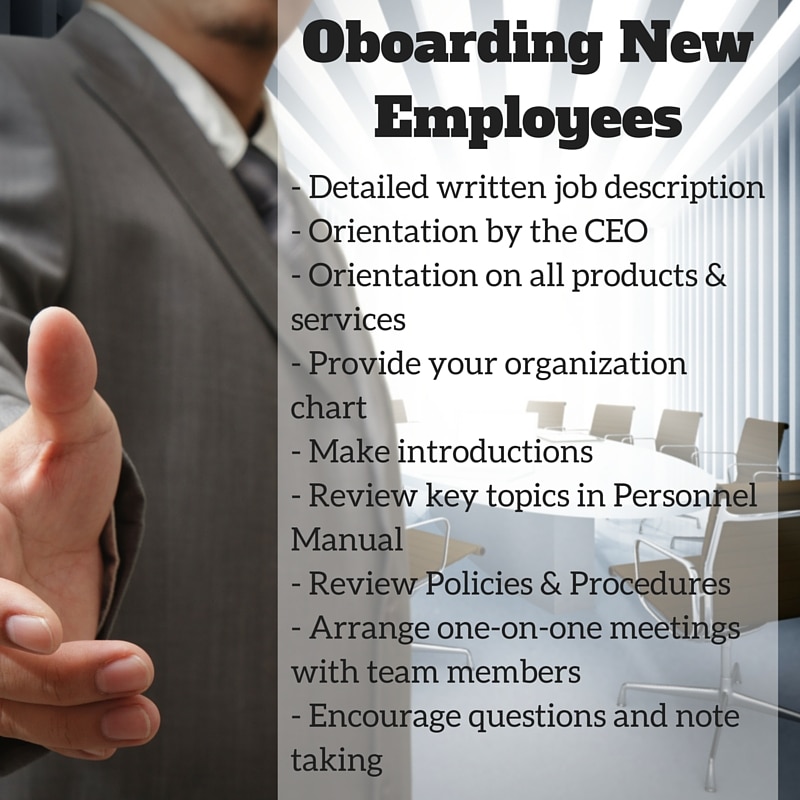

9 Onboarding Techniques That Increase Retention

It takes a lot of time and money to hire a new employee. It’s more than just paying their salary – it’s the labor and cost of recruiting, training, and onboarding them into the work environment. This is why employee retention is so important for any business. Not only does high turnover cost you more money, […]

One Way to Gain an Edge on National Tax Firms

“I know you’re a tax preparer, but I file [insert special tax situation], do you know how to prepare taxes for someone like me?” This question is bound to happen as a tax preparer. While you know that your tax training (hopefully) covered their specific situation and that you can most likely help them, what […]