We’ve talked about using client surveys to improve upon your processes and service each tax season but what about employee feedback? Good business owners take employee feedback into account when looking to improve, attract new talent, and grow. According to Daniel Hood in Accounting Today, “Many of the firms on our 2015 Best Firms to […]

Displaying: Income Tax School

Is Your Team Ready For Tax Season?

The holiday season is almost upon us, which means tax season is around the corner. Are you prepping employees and staff for the upcoming season? There’s a lot to prepare for – especially if you have a staff! You may think you have plenty of time to prepare, but the holidays go by so quickly […]

10 Basic Keys to Leadership

Being in charge does not make you a leader. Leadership is the ability to do more than manage, but to grow, develop and lead your team, employees, and organization in the direction you set. Leadership is a quality that takes development. While there are many different types of leaders, all of them possess these 10 […]

How to Motivate and Retain Employees

Employee retention is essential to maintain customer relationships and minimize recruiting and training costs. The keys to employee satisfaction and retention are founded on strong leadership and sound management practices. By mastering these arts, you should have happy, loyal employees and customers, resulting in growth, profits and personal gratification. Here are some ways to ensure […]

Strategic Business Plan Essentials

A Strategic Business Plan is important to your company’s growth and success. Have you thought of and included all of the essential things needed to make a strong and effective plan? Here are the essentials. Company Mission Your company Mission Statement is a very important part of your organization. Your mission statement is what drives […]

What to Know About Filing Same-Sex Marriage Returns

Thanks to the Supreme Court ruling that state bans on same-sex marriages are unconstitutional, this coming tax year will be the first year that Gay and Lesbian couples can file jointly as married couples. So what does that mean for us as tax preparers with same-sex couples who decide to tie the knot or who […]

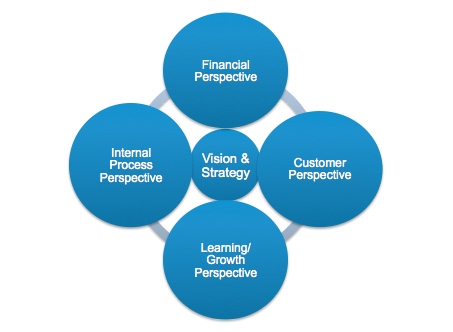

Executing Your Strategic Plan With A Balanced Scorecard

Do you have a strategic plan in place for the growth of your business? If so, good for you! (If not, you might want to check out this blog post). Strategic planning is crucial to growth no matter what industry you are in; but for the tax industry and all of the changes we’ve been […]

Becoming a Tax Business Owner Doesn’t Take Much

Set your own schedule. Make your own rules. Answer only to your clients. Who doesn’t want to be their own boss, right? If you’re getting into, interested in, or are already working in the tax industry, you may be surprised at what little it takes to start your own business as a tax preparer. Getting […]

Adopting A Servant Leadership Model For Your Tax Business

Servant leadership is at the heart of how we do business both at The Income Tax School and at Peoples Tax, our sister company. It’s so important as a business owner that you set strong values for your organization to follow. For us, servant leadership is one of those values. As a business owner, the […]

Why Every Tax Business Owner Needs a Strategic Business Plan

Those of us who derive our income from tax preparation continue to face the challenges of fierce competition and seasonality. We know the tax business and how to operate profitably as we’ve always done. But we are now faced with unprecedented threats posed by legislation and technology. These new trends will radically change the […]