Are you gearing up to take the IRS Special Enrollment Examination (SEE) to become an enrolled agent (EA)? Congratulations on taking this crucial step toward advancing your career in taxation. As you prepare to sit for the SEE exam, it’s natural to feel a mix of excitement and nerves. However, with the proper preparation and […]

Displaying: Exam Review

What does it take to become an enrolled agent?

Taking a position as an enrolled agent can be a hefty boost to your paycheck and professional outlook long into the future. Not only will you see job security and earn a living wage, but employers everywhere will immediately know your value, putting you above candidates without the EA credential on their resume. You’ll also […]

Finance vs. Accounting: Choosing the Right Major for Your Career

As you navigate your college journey, choosing the right major is one of the most significant decisions you will face. Among the myriad options, finance and accounting are lucrative and prestigious paths, each offering unique opportunities and challenges. Whether you’re drawn to the dynamic world of finance or the stability of accounting, understanding the nuances […]

Career Paths for CPAs Beyond Public Accounting

Embarking on a career as a certified public accountant (CPA) often begins with visions of a traditional path in public accounting. While public accounting can offer valuable experience, it’s essential for college accounting and finance students and early career accountants to know that alternative career paths exist, providing diverse opportunities to leverage their CPA designation. […]

How Long Does It Take to Study for the EA Exam?

Embarking on the journey to become an enrolled agent (EA) is a significant step toward a rewarding career in taxation, but mastering the EA Exam poses its own challenges. The key to success lies not just in hard work but in adopting a strategic and efficient approach to your study plan. At Surgent, we understand […]

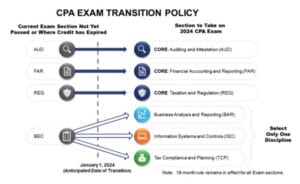

Transition Policy Lets Candidates Keep Passed CPA Exam Sections

We have great news as you enter the CPA exam journey! NASBA approved an amendment to the UAA, allowing state boards to extend the CPA Exam pass window from 18 months to up to 30 months, giving candidates up to an extra 12 months to pass all four parts once they pass their first section. […]

The benefits of CMA certification for small businesses

If you run a small business, you always have a list of potential roles to fill in the back of your mind: office administrator, receptionist, salesperson, etc. But what about a certified management accountant (CMA)? Chances are, you’ve either already hired or have considered hiring a bookkeeper or an in-house accountant. However, an accounting professional […]

Top accounting certifications for today’s market

Accounting certifications are vital in today’s competitive job market for finance professionals. By obtaining a top accounting certification, professionals can demonstrate their expertise, enhance their credentials and increase their career prospects. Employers value candidates with the best accounting certifications, as these credentials ensure they have the necessary knowledge and skills to succeed. Additionally, top accounting […]

Decoding the CPA Exam: Your Final Blueprint for Success

Everything evolves, and that includes the CPA Exam. As AICPA discovered in recent years, the exam hadn’t kept pace with the needs of accounting firms. They were hiring fewer accountants and more people skilled in data analytics, IT and cybersecurity. The discovery prompted AICPA and NASBA to develop the CPA Evolution licensure model, a revision […]

7 study tips for the CIA Exam

You’ve decided it’s time. You’re going to take the Certified Internal Auditor (CIA) Exam and accelerate your career. It’s a good move. The CIA is the “gold standard” of internal auditing, an essential credential for clients and employers who demand the strictest internal controls to maintain compliance in a dizzying business climate. The CIA is […]