The tax deadline may be in the past but we all know there’s still work to do. The good news is that the influx of people who need things last minute is on a downturn and the end of the season is in sight! At this point of the year, we generally encourage tax pros […]

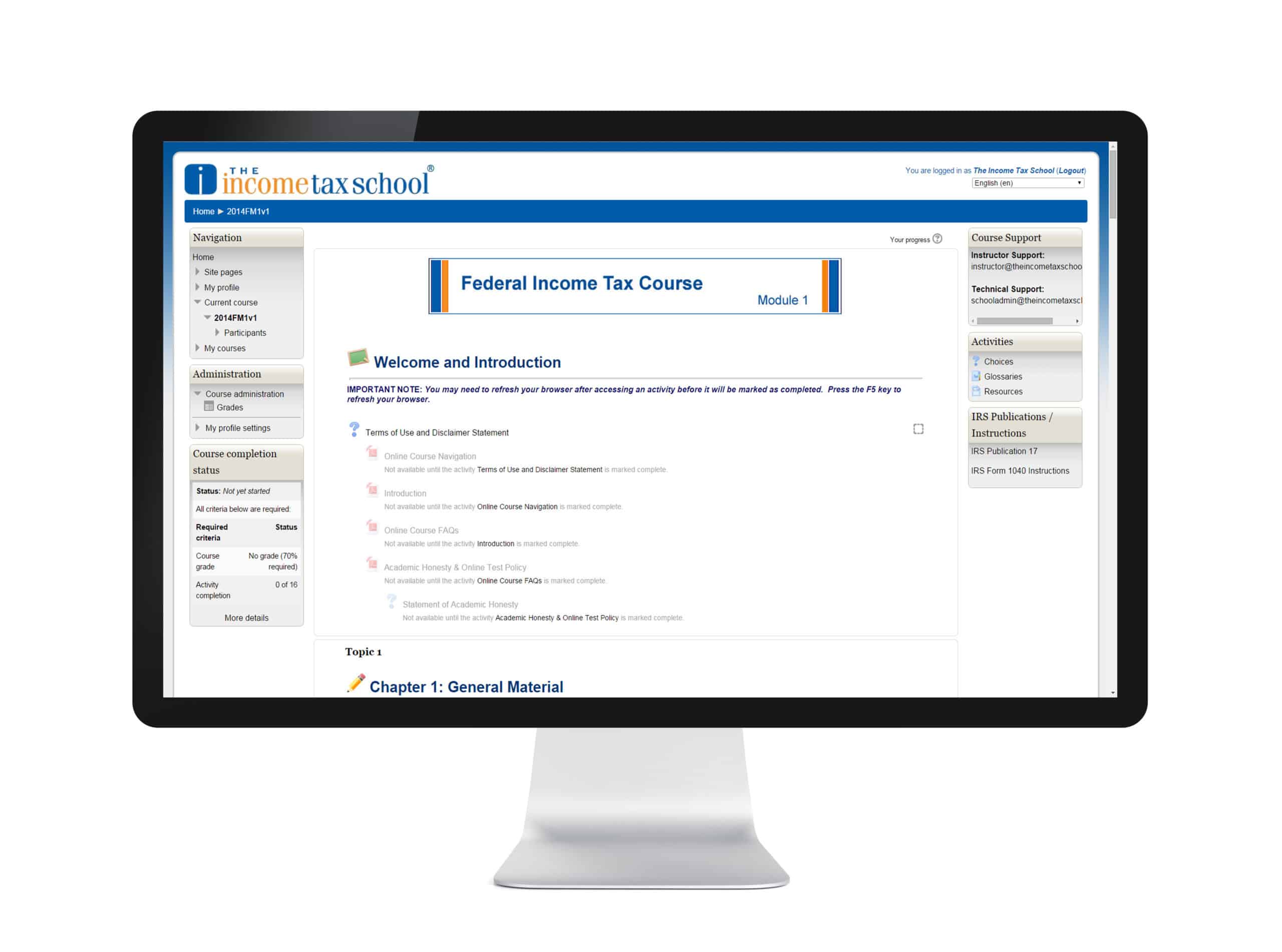

Displaying: Income Tax School

Tax Evasion vs. Hollywood Actors

Guest blog post by Mitchell Collins The IRS likes going after Hollywood actors and other famous people for tax evasion because it puts the fear of audit into the hearts and minds of fans everywhere. When the IRS audits popular celebrities or hauls them off to prison for failure to pay their taxes, people quickly […]

3 Ways to Earn PR for Your Tax Business

In the world of digital marketing, there are three types of content (or medias): earned media, paid media, and owned media. Earned media is press (PR). When you get a mention or article written about you (without paying for it), that’s earned media. Paid media is content about you that you paid for like advertisements, […]

Have Your Clients Done a ‘Paycheck Checkup?’

The IRS has been pushing taxpayers to perform a “paycheck checkup” this week to ensure the correct amount of tax is being taken out. Having too much taken out of your paycheck could mean giving too much of your money to the government to “hold” while having too little taken out could mean owing money […]

The Power of Connectors

Have you ever made a life-changing connection? An introduction to someone new can be a powerful force. New connections are made everyday, expanding personal networks and opening up doors to new opportunities. You may not give much thought to the connections you make on a day-to-day basis, but these interactions are a great opportunity to […]

Influencer Marketing 101: How to Grow Your Tax Business

In 2018, you’d be hard-pressed to find someone who hasn’t used or heard of social media. Facebook is a driving force in the way brands do business. Instagram and Twitter are changing the way consumers discover new products. If you’re not actively devoting time to getting your message out on these channels, you’re missing out […]

Blockchain and Accounting

Last week we talked about how the IRS views cryptocurrency, this week we’re talking about the platform cryptocurrency is built on: Blockchain. Why do tax preparers and accounting professionals need to know about Blockchain? Because the technology has the potential to change the industry all together. Here are some things you should know about Blockchain […]

Are You Talking to Clients About Cryptocurrency?

You’ve likely heard of Bitcoin. Maybe even Ripple or Ethereum. But have you paid much attention? No, these are not made-up words, they are forms of Cryptocurrency. Crypto what? A Cryptocurrency is a digital asset (or currency) that is traded and secured using cryptography. You don’t need a bank to trade this currency, you can […]

Guide to Start and Grow Your Successful Tax Business Named Top Product

Good News! My new book, “Guide to Start and Grow Your Successful Tax Business”, has been featured for Honorable Mention in the February 2018 Accounting Today magazine among The 2018 Top New Products. According to Accounting Today, “It’s worth remembering that not all the tools accountants use are software applications, and the Honorable Mention […]

Who Is Your Ideal Tax Client?

Tax business owners who are just starting out often get fatigued when it comes to acquiring new clients. When asked who their ideal client is, the answer tends to be “everyone!” While it’s true that everyone has to pay taxes, casting that wide of a net is not the best practice. Here are some guidelines […]