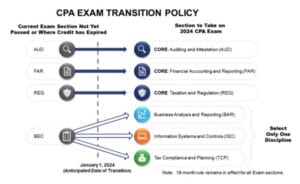

We have great news as you enter the CPA exam journey! NASBA approved an amendment to the UAA, allowing state boards to extend the CPA Exam pass window from 18 months to up to 30 months, giving candidates up to an extra 12 months to pass all four parts once they pass their first section. This is independent from the one-time, 18-month extension for outstanding sections on Jan. 1, 2024. NASBA also redefined the start of the pass window to the date the scores are released and not the date the candidate sat for the CPA Exam. Both of these changes are advantageous to CPA candidates and will give them more time and flexibility to complete their journeys to becoming CPAs.

Source: NASBA “Transition Policy Announced for the 2024 CPA Exam Under the CPA Evolution Initiative”

Jack Castonguay, Ph.D., CPA, serves as the Vice President of Strategic Content Development – Accounting, Finance, and Exam Prep. He holds a BBA in Accounting and a Master of Science in Accounting from James Madison University and received his Ph.D. in Accounting from the University of Tennessee. Jack began his career in public accounting with a Big Four accounting firm auditing manufacturing and financial services clients. He has taught financial accounting, auditing, and research seminars at the graduate and undergraduate levels and is currently an assistant professor at Hofstra University. Jack maintains an active CPA license.