Having one procrastinating client is bad enough. More likely, you have at least a dozen really bad procrastinators. But when 80% or more of your clients turn in their shoe boxes of receipts to you on April 1 – or later – you’re going to have problems. Because procrastinating clients can actually cost you money. […]

Displaying: Income Tax School

Top Tax Scams this Tax Season

The IRS just completed its compilation of this year’s “Dirty Dozen Tax Scams” – a list they put out each year that contains the worst of the worst. Tax scams are still a big problem despite the extra precautions the IRS has implemented within the last couple of years. While it has improved, there are […]

Are Online Reviews Hurting Your Business?

How many stars does your company business page have on Facebook? How about your local BBB page? Online reviews are everywhere and believe it or not, they are worth looking into. Did you know that 91 percent of people regularly or occasionally read online reviews, and 84 percent trust online reviews as much as a […]

5 Ways to Keep Your Employees Motivated Through the Busy Tax Season

If one of the reasons you decided to open (or are thinking about opening) your own tax preparation business is because you’ve had miserable experiences working for others, ask yourself this very important question: What are you doing not to repeat those same mistakes with your employees? Especially during tax season. What are the top […]

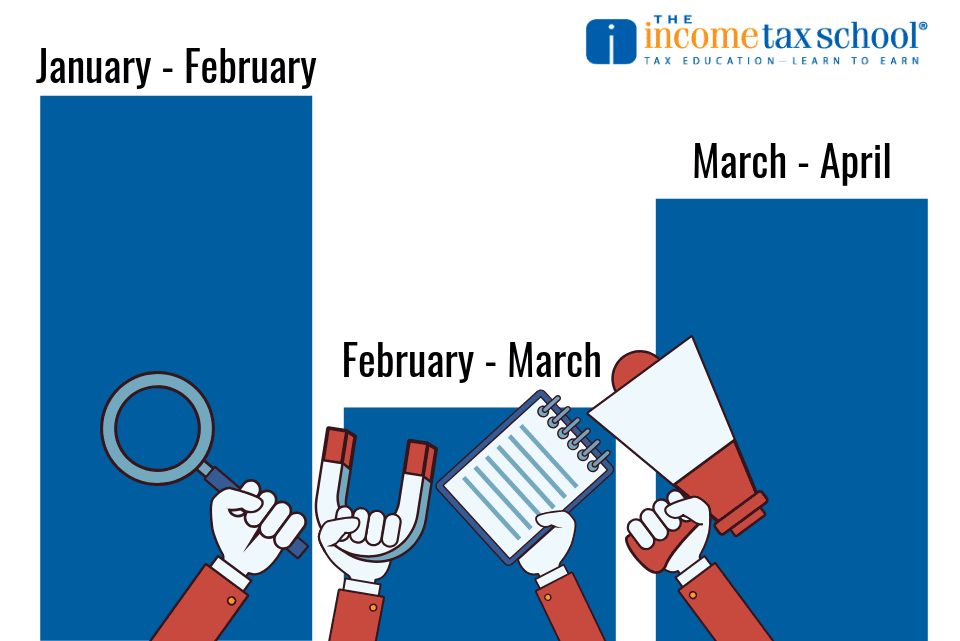

Tax Season Communications Throughout the Season

When it comes to marketing your tax business, the same messaging all year long is not going to cut it. As you progress throughout the season, your message needs to appeal to different types of taxpayers. Here’s a peek at what we do over at our sister company, Peoples Tax, and what we recommend for […]

Are You Leveraging LinkedIn As a Tax Pro?

LinkedIn is a powerful social networking channel designed for business professionals to share knowledge, connect, and build their network. It’s a great tool for tax professional for a number of reasons, but only if you’re using it to its full potential! We haven’t blogged about LinkedIn in a while so we thought since we are […]

Have Some Heart with Cause- Related Marketing

It’s Heart Month and Valentine’s Day so I thought I’d use this opportunity to talk about giving back through cause-related marketing. During tax season, our sister company Peoples Tax hosts a backpack drive for a local charity called Connor’s Heroes. Connor’s Heroes is a non-profit that gives support and companionship to children in cancer treatment […]

January Tax News Recap: Tax Law Changes Here We Come

If you thought there wouldn’t be much in the way of tax news in January during the government shutdown, you would be wrong. January was an exciting month, as the IRS clarified rules that were changed or introduced in the Tax Cuts and Jobs Act in December 2017. Here’s a quick rundown of some of […]

Top 4 Client Retention Strategies for Your Tax Preparation Business

If you haven’t done it already, this is the perfect time of year to put any one of these top 4 client retention strategies for your tax preparation business into place. Client retention should be a strong, foundational piece in your overall marketing strategy. Some of these strategies can be (and should be) used throughout […]