In 2018, you’d be hard-pressed to find someone who hasn’t used or heard of social media. Facebook is a driving force in the way brands do business. Instagram and Twitter are changing the way consumers discover new products. If you’re not actively devoting time to getting your message out on these channels, you’re missing out […]

Displaying: Income Tax School

Blockchain and Accounting

Last week we talked about how the IRS views cryptocurrency, this week we’re talking about the platform cryptocurrency is built on: Blockchain. Why do tax preparers and accounting professionals need to know about Blockchain? Because the technology has the potential to change the industry all together. Here are some things you should know about Blockchain […]

Are You Talking to Clients About Cryptocurrency?

You’ve likely heard of Bitcoin. Maybe even Ripple or Ethereum. But have you paid much attention? No, these are not made-up words, they are forms of Cryptocurrency. Crypto what? A Cryptocurrency is a digital asset (or currency) that is traded and secured using cryptography. You don’t need a bank to trade this currency, you can […]

Guide to Start and Grow Your Successful Tax Business Named Top Product

Good News! My new book, “Guide to Start and Grow Your Successful Tax Business”, has been featured for Honorable Mention in the February 2018 Accounting Today magazine among The 2018 Top New Products. According to Accounting Today, “It’s worth remembering that not all the tools accountants use are software applications, and the Honorable Mention […]

Who Is Your Ideal Tax Client?

Tax business owners who are just starting out often get fatigued when it comes to acquiring new clients. When asked who their ideal client is, the answer tends to be “everyone!” While it’s true that everyone has to pay taxes, casting that wide of a net is not the best practice. Here are some guidelines […]

8 Ways to Gain New Clients This Tax Season

It’s the start of a new tax season. Is your marketing plan in place and ready to go? Do you how you’re going to get new clients this year? Marketing plan or not, here are some ideas to help you get clients through the door. It Pays to Pay Attention Do you keep an eye […]

Tax Scams Abound This Tax Season – Tips to Stay Incident Free

Tax season is officially here! In addition to the start of the season, this week is Tax Identity Theft Awareness Week. Despite all of the safeguards the IRS has put in place to stop cybercriminals, it’s still our duty as tax preparers to educate clients, and follow strict online security procedures to protect sensitive data. […]

Don’t Stop Learning: What the new Tax Bill Means for Tax Education

The dust is still settling from the passing of the new tax bill. The IRS hasn’t updated the tax forms on its website… AND the start of the tax season is looming. We’ve been getting lots of questions about whether or not to bother taking tax courses right now. Here are some important things to […]

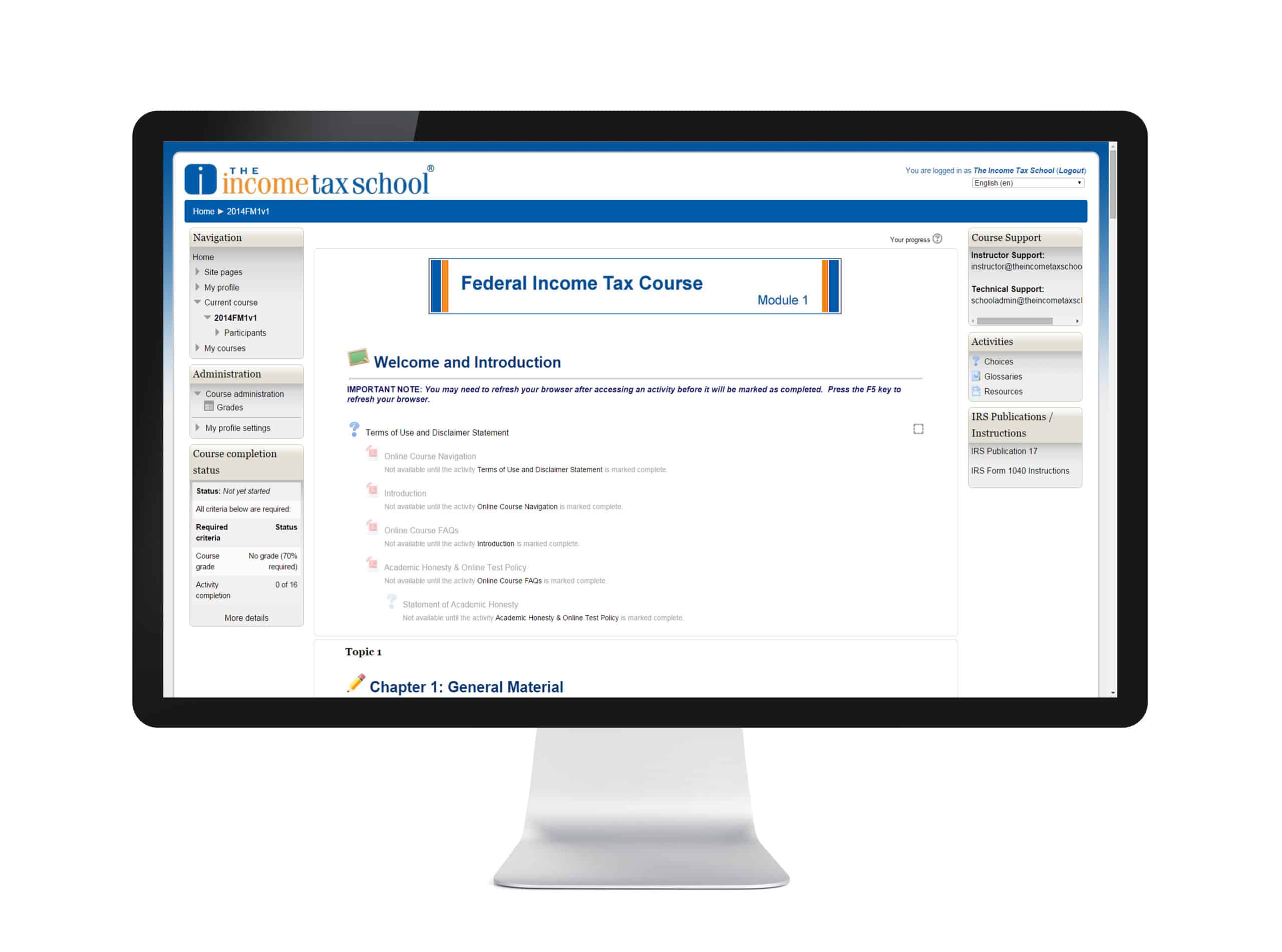

Chartered Tax Professional (CTP) Certificate Program (Test Copy)

CTP® Certificate Program Includes: nnA series of five Income Tax Courses totaling 180 hours must be completed within 18 months. Plus, there is a 500-hour experience requirement. Study anywhere/anytime with an Internet connection.nn nn Comprehensive Tax Course – 60 hours nn Advanced I Tax Course – 30 hours nn Advanced II Tax Course – 30 […]