The Institute of Internal Auditors (IIA) is expanding the Certified Internal Auditor exam to several new languages to accommodate international candidates seeking the credential. As the only globally recognized internal audit certification, it is important that the CIA exam be accessible to a multitude of audiences across the world. The IIA estimates that there are […]

Displaying: Recent Posts

IIA Changes CIA Eligibility Requirements

Starting September 1, 2019, The Institute of Internal Auditors has changed the Certified Internal Auditor (CIA) program eligibility window from four years to three years. This change reflects the time it normally takes candidates to complete the CIA certification process, and candidates within the three-year program will be able to request a one-year extension if […]

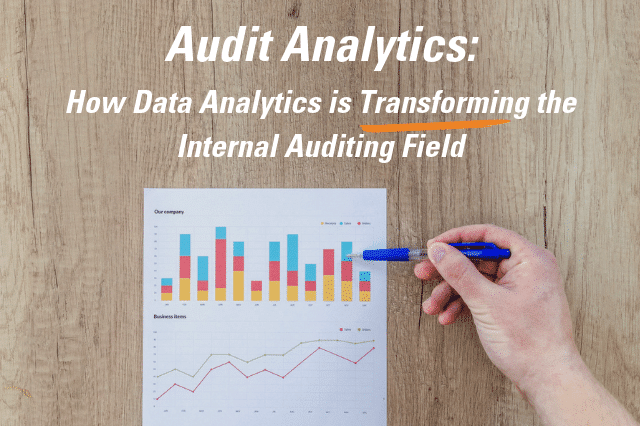

Audit Analytics: How Data Analytics is Transforming the Internal Auditing Field

In today’s business environment, how a company works with “big data” has become analogous with how well that company does within its industry or market. Being able to effectively work with data to drive business decisions and develop business insights is the difference between a competitive company and a company behind the curve. Data analytics […]

Tax News Recap: New Forms, Cybersecurity, and Career Opportunities

It may not be tax season, but it sure does feel like it with all the tax news and updated information from the IRS! Have you been paying attention? Don’t sleep on these important tax news headlines. New forms This month the IRS announced a couple of new forms. First, a new form for seniors […]

Why Learn in the Classroom When You Can Learn Online?

The traditional classroom is not the only way to learn. We’re in the digital age now where books can be read on tablets and things can be learned on YouTube (not taxes, obviously). There are now hundreds of schools who offer degrees online and hundreds of platforms where you can gain certifications for a number […]

8 Common Tax Problems Every Tax Preparer Should Be Ready For in 2020

2018 had some major tax changes due to the Tax Cuts and Jobs Act. And while we’re still recovering from these changes (or still working through them with our extended filers), it’s time to start looking into what tax problems we’ll be working with for the 2019 tax year. Most of the changes to the […]

SOC for Cybersecurity: A guide to managing risk for CPAs

One of the biggest concerns for organizations in today’s business environment is cybersecurity. Cybersecurity in its most basic form is the protection of electronic data from unauthorized or criminal access and use. As businesses capture more and more data, both internally in relation to the operations of the company and externally in relation to the […]

Top CPA Exam resources for accounting students

Coming into the first semester of college can be hard enough without having to research information about the CPA Exam. From balancing studying for classes with studying for the CPA Exam to diverse career paths within the field of accounting, we’ve put together a list of essential articles for accounting students to read on their […]

Payment Plan Option for Comprehensive & Small Business I Tax Course Bundle (2019)

*Initial payment due at checkout includes $40 signup fee and 1st month’s payment.* n*Does not include any hard copy books or other add-ons purchased with your order. All hard copy books and/or other add-ons will be paid at checkout innaddition to signup fee and first month’s payment.n n n Standard Edition (without books): n$232 for […]