Our team had such a great time this year attending the IRS Nationwide Tax Forums! We were in Orlando, Las Vegas, Dallas, National Harbor, and San Diego meeting with tax preparers and talking about tax education. We love meeting new people, answering questions, and reconnecting with our “Road Family” – people we see year after […]

Displaying: Recent Posts

Digital Access – EA

Free Resources for Tax Preparers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders. That’s why, along with all of the materials and support we provide to students, we also strive to write informational blog posts and other free sources of information. Did you know […]

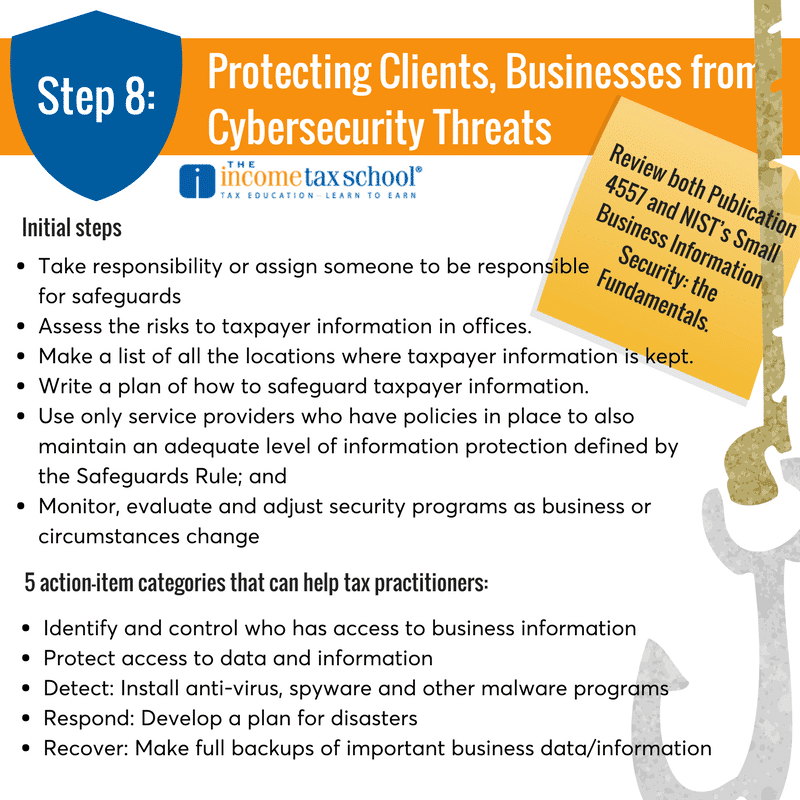

Protect Your Clients From Cybersecurity Threats

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to do so through their Don’t Take the Bait campaign, a 1o part series […]

COSO updates enterprise risk management framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) released the ERM (Enterprise Risk Management) Framework: Enterprise Risk Management–Integrating with Strategy and Performance on September 6, 2017. This is COSO’s first significant update to the original 2004 ERM document, Enterprise Risk Management–Integrated Framework. The provisions of the updated ERM framework become testable on the […]

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could […]

FASB simplifies accounting for derivatives and hedging instruments

The Financial Accounting Standards Board (FASB) has issued Accounting Standards Update No. 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. The provisions of the new ASU are effective for fiscal years beginning after Dec. 15, 2018. The content becomes testable on the CPA Exam Jan. 1, 2019. ASU No. 2017-12 […]

Introducing: Guide to Start and Grow Your Successful Tax Business

I’m excited to announce the release of my book, Guide to Start and Grow Your Successful Tax Business! This 289-page book is a go-to guide for anyone looking to start or grow a tax business. The guide covers everything from learning tax preparation, to establishing your tax office, marketing and pricing, recruiting and training employees, […]

The Benefits of Guest Blogging for Your Tax Business

Content marketing has become an important part of marketing for every business. Beyond sharing your expertise on your blog or creating white papers for download, there’s another great option – that could help get you in front of fresh eyeballs. It’s called guest blogging. Guest blogging is just what it sounds like. Creating original content […]