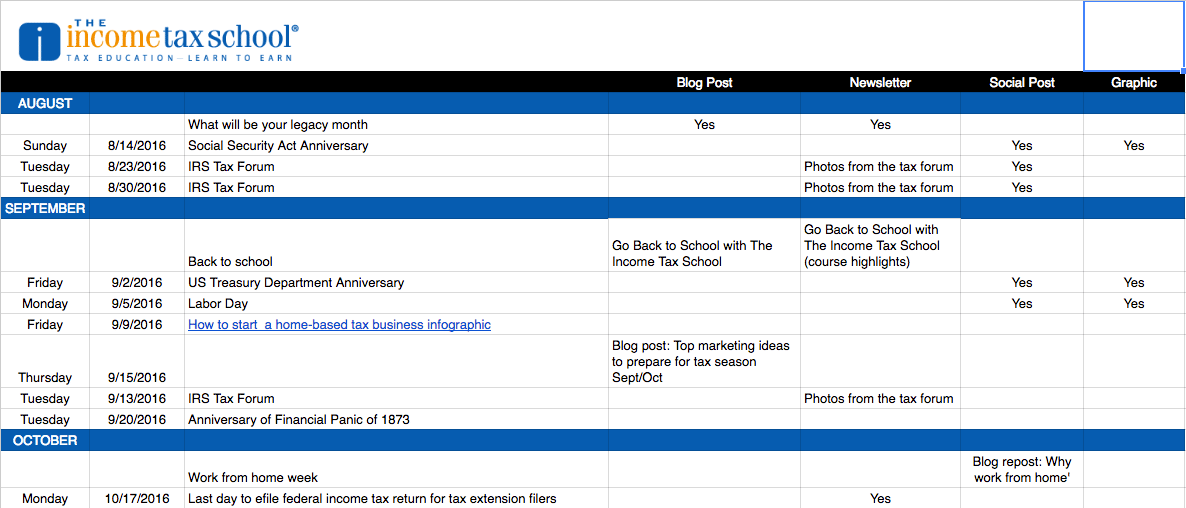

If you run a tax business, there are always things to do year round to prepare for the current, next or upcoming tax season. Taxes are a seasonal business but as a business owner, you should always be in building and planning mode. Now that’s it’s fall, tax season is right around the corner. Here […]

Displaying: Recent Posts

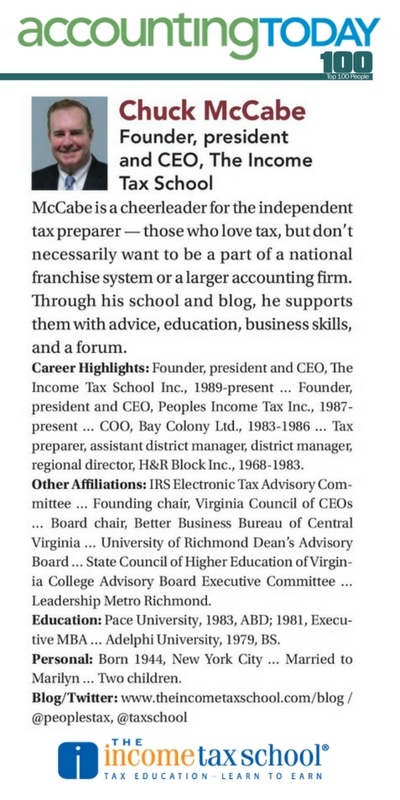

Accounting Today’s 2016 Top 100 Most Influential People in Accounting

I am excited and honored to announce that I have been named among Accounting Today’s 2016 Top 100 Most Influential People in Accounting. Each year, Accounting Today names the top 100 “thought leaders, visionaries, regulators, and others who are shaping the profession.” This is the 4th year I’ve been included in this prestigious list. Below is the […]

FASB announces ASU 2016-14 – NFP Standards will be testable January 2018

The FASB issued Accounting Standard Update 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities. The update was designed to improve existing standards, and is eligible to be tested on the CPA Exam in January 2018.

FASB releases Standards Update on Statement of Cash Flows

On August 26, 2016, the FASB issued Accounting Standard Update 2016-15, Statement of Cash Flows (Topic 230).

Everyone Can Benefit From Going Back to School

The kids are about to go back to school, why not join them? No, you can’t go to school with your kids, but you can further your education and grow as a tax preparer. Expanding on your tax knowledge is beneficial to your clients, yourself, and your business if you are a business owner. Here are […]

Why Retirement is a Great Time to Become a Tax Preparer

We talk a lot about making a career as a tax preparer because we’re so passionate about seeing people go from tax student to successful tax preparer – or self-employed tax business owner. But tax preparation doesn’t have to be a career, it’s also a great way to make money on the side after retirement. Here […]

17 Crucial Metrics Every Tax Office Should Be Tracking

Are you going through the motions every tax season? If you’re not tracking the right metrics and making improvements to grow your business each year then yes, you are just going through the motions. Looking at your bottom line is important, but your bottom line is only going to tell you whether or not you […]

5 Essentials to Developing a Client Newsletter

Email newsletters are a great way to keep in touch with clients year-round. They add a personal touch, keep clients in the loop, and are sharable. We’ve discussed their importance before, but have yet to go into developing a solid newsletter. We got a great question on a recent blog post (5 Marketing Things to do […]

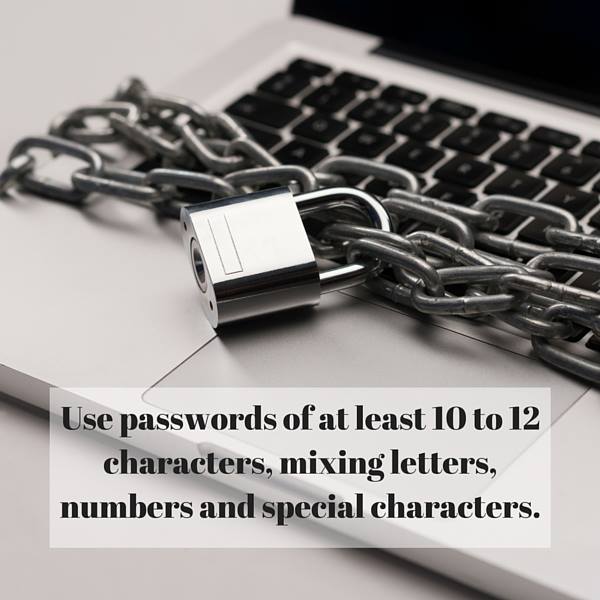

How to Protect Your Clients’ Information

As a tax preparer, you are privy to a lot of confidential information – information that could do your clients severe harm if it ended up in the wrong hands. This year, the IRS has been making a lot of changes to their processes to help guard taxpayers against the growing number of individuals who commit […]