The IRS’ authority is once again being questioned. This time it’s over the Preparer Tax Identification Number (PTIN) fees that you are required to pay annually in order to prepare returns for compensation. This class action lawsuit is being filed by a pair of CPAs: Adam Steele of Bemidji of Minnesota and Brittany Montrois of […]

Displaying: Recent Posts

Why Every Tax Business Owner Needs a Succession Plan. Now.

You’re not going to run your tax business until the day you die (unless of course you die unexpectedly), which is why it is essential for you to have “key man” life insurance. At some point in life, it will be time to retire. You may already have your retirement plan mapped out financially, but […]

How to Choose the Right Tax Education Provider

There are a lot of different choices out there for tax education and training and they are all not equal. Choosing the right school can mean a lot of research and emailing back and forth with instructors or sales people to make sure you choose the school with the best value that fits your needs […]

How to Reduce Your Turnover in a Seasonal Job Market

We recently got a great question on our Facebook page about turnover at tax offices. “Many of the tax offices seems to have to recruit and train preparers every season, why the turnover?” This person is correct in thinking that tax offices have a high turnover because frankly, most of them do! The reason for […]

Affordable Care Act Updates Tax Preparers Should Know About

As we make our way towards the 2015 tax season, the Affordable Care Act and how it will affect the upcoming season seems to be coming clearer… little by little…. While there are still a number of questions to be answered, we thought we’d compile some updates from the past couple of months to help […]

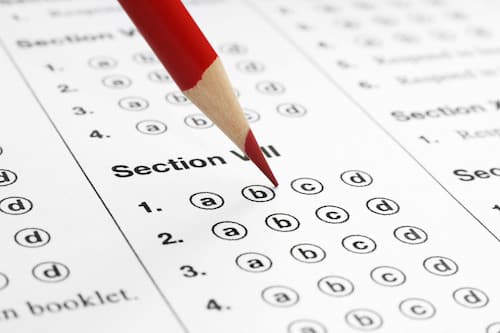

A Sneak Peak At What’s Covered in the IRS Annual Federal Tax Refresher Course

If you are an unenrolled tax preparer, you are most likely weighing your options on whether or not to take the Annual Federal Tax Refresher Course (AFTR). You’re probably also wondering what you’ll learn and be tested on. The AFTR is a six-hour course that ends in a 100 question exam to test you on […]

Tax Pros: Are You Ready To Go Back to School?

The kids are going back to school today, which means you should too! As a tax preparer there are certain Continuing Education requirements you must meet and a new certification program from the IRS you should consider if you are an unenrolled preparer. Plus, learning to prepare more complicated tax returns will make you more […]

The Ultimate Marketing Plan Checklist For Tax Season Readiness

Have you developed your marketing plan for this coming tax season yet? Now is the time to start brainstorming and putting the pieces together for continued growth in 2015. If you’re not sure where to start, or just need some prompts, here is a checklist of things you should cover in your 2015 tax business […]

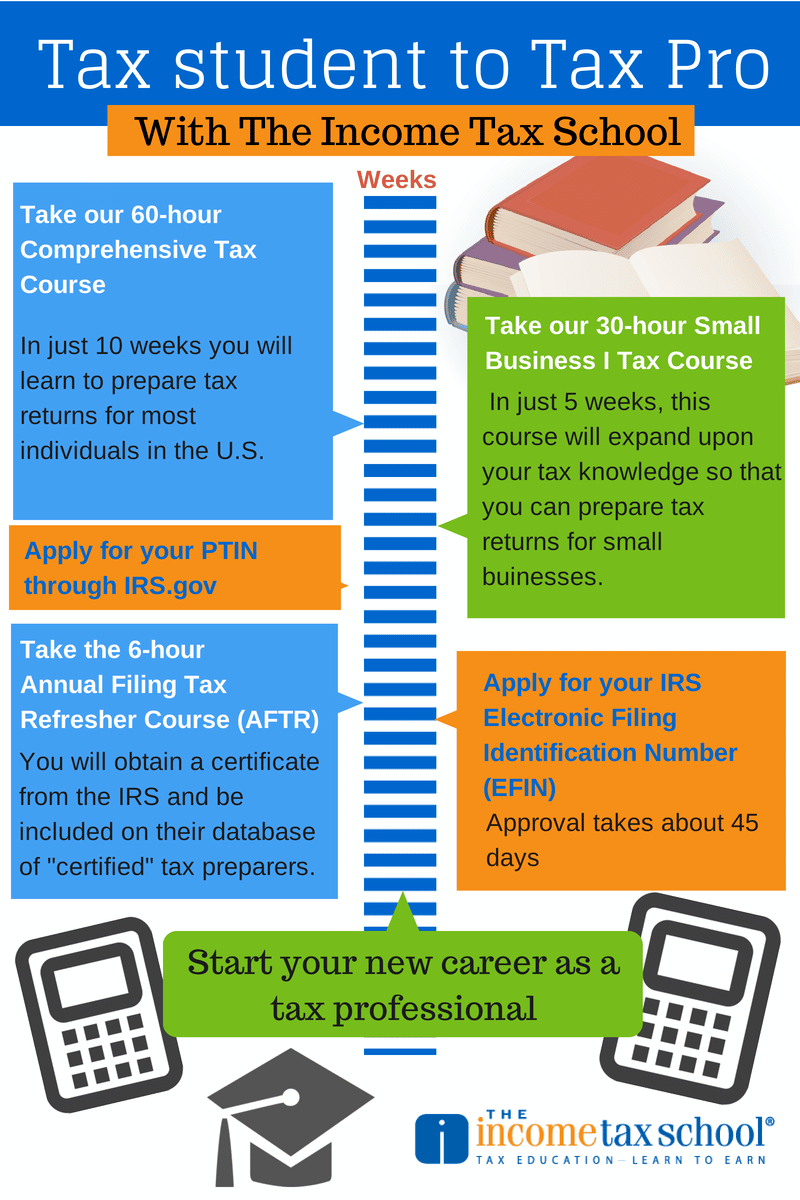

How to Become a Tax Preparer and Start Earning Money Before Tax Season

Looking for a new career? A career as a tax professional can be very rewarding and getting started doesn’t require any knowledge of the industry. Here’s how you can become a tax professional before tax season. Tax business start-up checklist Enroll in tax course (beginner and/or advanced tax courses) Read the New Rules for Federal […]