*Initial payment due at checkout includes $40 signup fee and 1st month’s payment.* n*Does not include any hard copy books or other add-ons purchased with your order. All hard copy books and/or other add-ons will be paid at checkout innaddition to signup fee and first month’s payment.n n n Standard Edition (without books): n$234.25 for […]

Displaying: Recent Posts

Payment Plan Option for Chartered Tax Professional (CTP) Certificate Program (2018)

*Initial payment due at checkout includes $135 signup fee and 1st month’s payment.* n*Does not include any hard copy books or other add-ons purchased with your order. All hard copy books and/or other add-ons will be paid at checkout innaddition to signup fee and first month’s payment.n n n Standard Edition (without books): n$149.70 for […]

EA vs CPA: Which One is Right for You?

EA vs CPA – From working in management to becoming tax professionals, accounting students have plenty of options when it comes to credentials and specializations. We’ll talk about two of the most popular tax-related credentials/licenses, the Enrolled Agent (EA) and Certified Public Accountant (CPA), explain how they’re different, and help you decide which credential is […]

Payment Plan Option for Comprehensive Tax Course (2018)

*Initial payment due at checkout includes $40 signup fee and 1st month’s payment.* n*Does not include any hard copy books or other add-ons purchased with your order. All hard copy books and/or other add-ons will be paid at checkout innaddition to signup fee and first month’s payment.n n n Standard Edition (without books): n$165.67 for […]

Tax Season Is Over but the Self-Employed Still Need Your Help

If self-employed individuals are not on your radar, perhaps they should be. New research from Intuit Self Employed uncovers some very telling facts about this segment of taxpayers: 36% of self-employed workers admit they don’t pay taxes. Nearly 1 in 10 self-employed workers don’t know about the recent tax reform. More than a fourth of self-employed […]

Tax Law Updates Webinar: Prerecorded

Tax Law Updates – Prerecorded Webinar nThis is a One-Hour Prerecorded Webinar. Original recording was 1/24/18 from 1:00-2:00 p.m. EST. nPlease note: This is a non-refundable purchase. Thank you!nnDate/Time: On DemandnnCE/CPE Awarded: N/AnnThis informative webinar will help you decode the recent tax law changes for 2018 tax season and going forward.nnPresenters:n n Ty Gaines, EA, […]

Are Earnings from Cryptocurrency Mining Subject to Tax?

Cryptocurrency is an emerging technology that an increasing number of taxpayers are looking into. While you probably don’t have a lot of clients who use cryptocurrency, it’s important to stay on top of emerging trends. We’ve written before about cryptocurrency and how the IRS views it. Here’s an article by Coincentral.com that take a deeper […]

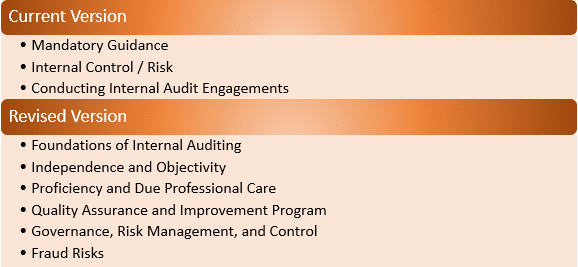

Internal Auditors: Everything You Need to Know About the 2019 CIA Exam Changes

In January 2018, the Institute of Internal Auditors (IIA) announced major changes to the Certified Internal Auditor (CIA) exam. In this post, we’ll cover the why, when, and what of the CIA Exam changes, and how you can properly prepare yourself to pass the new exam. Why is the CIA Exam Changing? Internal audit practices […]

3 obstacles accounting students face to becoming a small business adviser

With flexible scheduling, the ability to niche, and work that truly helps others, owning a small business advising practice is a great career path for accounting students. But building a business takes hard work, patience and persistence; it’s a path reserved for those who are willing to put in the time and make it their […]