Statement of Auditing Standards (SAS) No. 133, Auditor Involvement With Exempt Offering Documents, was issued July 26, 2017, and provides performance requirements for auditors involved with documents for exempt offerings such as municipal securities; securities issued by not-for-profit religious, education, or charitable organizations; crowdfunding; small issues of securities such as Regulation A offerings; and franchise […]

Displaying: Recent Posts

New Guidelines on Passwords

You know all that advice about making hard passwords? They must include at least one number and special character. You know how we’re told to change the password frequently and to never use the same one for different things? Well, there are new guidelines that basically say to forget what you’ve been told. So, thanks […]

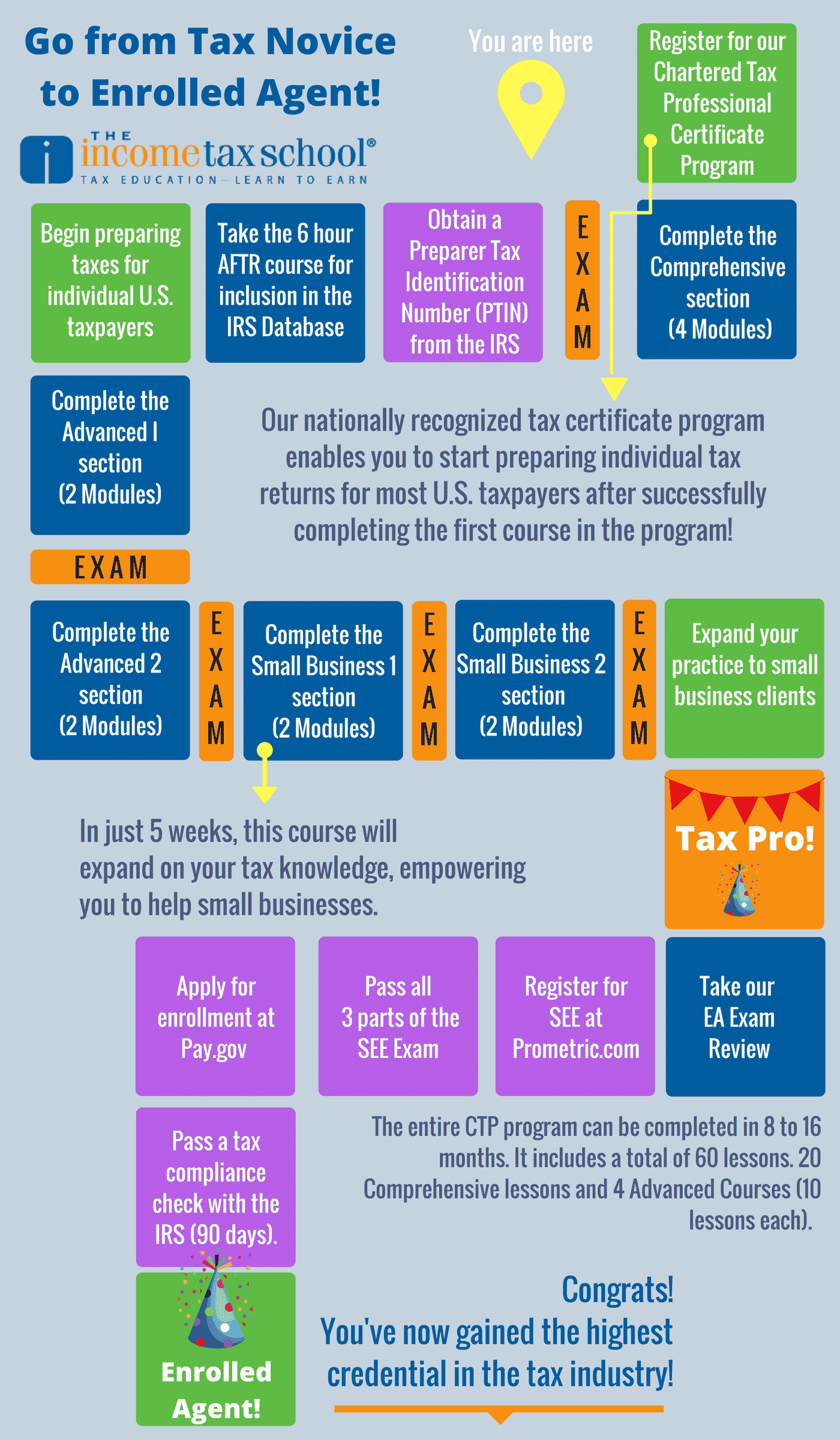

The Path to Enrolled Agent

If you’re looking for a career in the tax industry, set your sights high! While it doesn’t take much to become a tax preparer and start preparing taxes for the general public, earning a credential as an Enrolled Agent should be the ultimate goal. Enrolled Agents are the only credentialed tax preparer and thus have […]

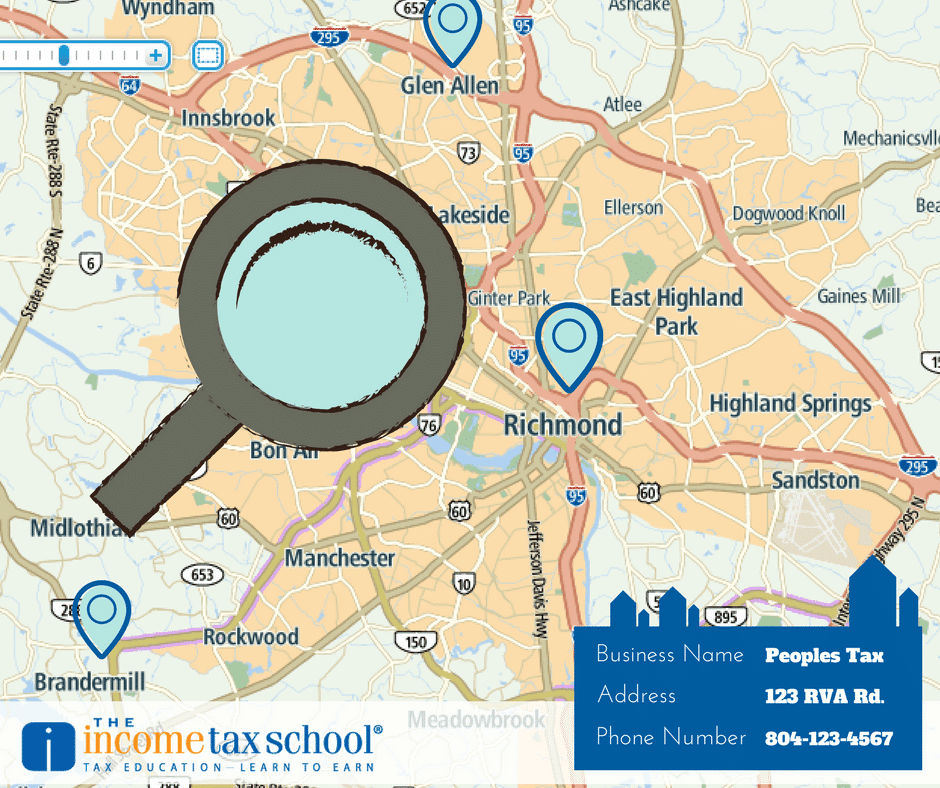

Online Directories: A Great Way to Boost Your SEO

When you type in “tax preparer in [enter your city]”, does your firm come up? Is it at the top of search results? There are a lot of things that factor into being on the first page of Google. Are you employing SEO tactics? Do you have a lot of competition? Is your site optimized […]

What Does the Use of AI in Tax Preparation Mean for Tax Preparers?

AI is the hot technology term these days. It seems to be “disrupting” just about every industry you can think of – including the tax industry. This past tax season, H&R Block partnered with IBM Watson to use its powerful AI capabilities in 10,000 of its U.S. offices. The initial focus of the technology was […]

3 reasons why a speedy CPA Exam review can benefit you

On the fence about a faster CPA Exam review course? Here are 3 reasons why a speedy CPA Exam review can benefit you, and what courses have the best offering, as reviewed by a university professor.

Expand Your Social Media Arsenal This Summer

Facebook, Twitter, LinkedIn… these are the three standard channels we all think of when it comes to social media marketing. But they aren’t the only ones. There’s also Instagram, Snapchat, YouTube and Pinterest (to name a few). Social media has a major force in marketing and communications – one that tax preparers should not be […]

FASB simplifies accounting for certain financial instruments

The FASB issued Accounting Standards Update No. 2017-11, which simplifies accounting for certain financial instruments and will be testable on the CPA Exam in April 2019. Taking FAR in Q2 2019 or later? You'll want to know this material!

Video: No. 1 reason to take the CPA Exam

What's the number one reason to take the CPA Exam? We talked to a millennial CPA who passed the CPA Exam and is currently working as an Accounting Manager. Watch her video to find out!