Once you pass those four dreaded sections of the CPA Exam, it doesn’t mean you have reached the finish line! There are requirements you must fulfill before you can put those three letters (CPA) at the end of your name. We break down these requirements.

Displaying: Recent Posts

Calculate your CPA Exam Misery Index

Remember the Misery Index from your college Economics class? We've applied it to CPA exam prep using cost of CPA review, hours studying, and sections taken. The lower your score, the better!

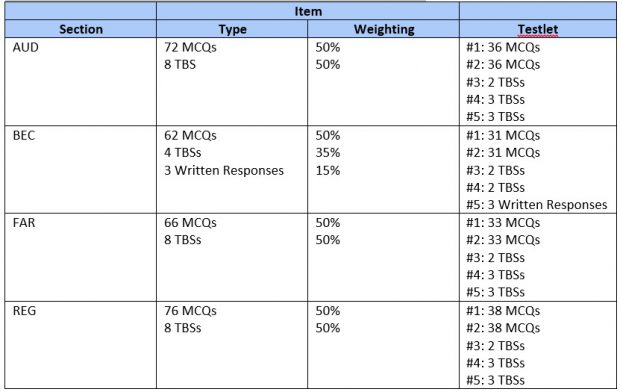

AICPA announces fewer simulations on the 2017 CPA Exam

Taking the CPA Exam in 2017 after April 1? We've got great news for you! On February 1, the AICPA announced there will be less task-based simulations on the exam.

For Tax Preparers, the Distinction Between Customer or Client is an Important One

As a tax preparer, CPA, or accountant, do you have customers or clients? Most would say clients without hesitation. But the distinction is an important one. Strictly defined, a customer is someone who buys goods or services from a store or business. The word “client” can also mean “customer,” according to the American Heritage Dictionary, […]

Testing for the CPA Exam before the 2017 changes go into effect

Testing for the CPA Exam before the 2017 exam changes? Know what changes became effective for this testing window.

What to know for the 2017 Tax Season

The 2017 tax season is underway! There are many things that will affect our industry up in the air since the new administration took office three days before the start of the season. There are a lot of proposed changes by President Trump but they will likely not take effect until next year. As we […]

Consolidation for not-for-profit entities will be testable on CPA Exam

The amendments in this update from the FASB are effective for NFPs for fiscal years beginning after December 15, 2016. The standard will become testable on the CPA exam October 2017.

Build Better Client Relationships This Tax Season

Today is Get To Know Your Customers Day and tax season is next week. We thought today’s blog post would be a great time to talk about the importance of knowing your customers since you’re about to see all of them within the next few months! For tax preparers, really knowing your clients is important. On the […]

Protect Yourself and Clients from Cybercrime this Tax Season

Cybersecurity and Cybercrime are two terms you’re going to hear a lot in 2017. That’s because Cybercrime continues to be a growing threat to consumers and businesses. According to Verizon’s 2016 Data Breach Investigations Report, “No locale, no industry or organization is bulletproof when it comes to the compromise of data.” IBM President and CEO Ginni […]