Your time, talent, and knowledge are valuable commodities. This is why many professionals hesitate to give anything that involves those things away for free. But free does not equal loss. In some cases it can actually benefit or help grow your tax practice. Between our sister tax firm, Peoples Tax, and The Income Tax School, […]

Displaying: Income Tax School

Get Social in 2017: A Social Media Checklist for Tax Preparers

The 2017 tax year is right around the corner. If you haven’t jumped on the social media train, you’re likely losing out to exposure and leads. Social media isn’t a magic bullet but it can have a huge impact on growth, reach, and exposure when combined with other marketing efforts this tax season. Here are some […]

Be Nice.

The nice bot wants to make the internet a better place. And we love it! It tweeted Peoples Tax a few months ago and the message has stuck with us. With all of the negativity in the world – especially on social media – the Nice Bot is a breath of fresh air. Being nice is […]

Doing Your Due Diligence

The IRS takes due-diligence requirements very seriously. In fact, in order to prepare for the upcoming season this year, they sent letters to paid tax preparers whom they suspected were noncompliant in meeting their Earned Income Tax Credit (EITC) due-diligence requirements. According to The Journal of Accountancy, the IRS estimates that between 22% and 26% […]

Essential Tax Office Training Check List

As the end of the year creeps up on us and the holiday parties pile up, it’s necessary to remain focused on preparing yourself, your tax office, and your employees for the upcoming tax season. If you’ve hired new tax preparers, training them is of utmost importance. On-boarding new preparers and training them on customer service […]

Important Items to Secure Before Tax Season

Are you ready for the upcoming season? If you haven’t renewed your PTIN then the answer is no. Anyone who prepares or helps prepare federal tax returns for compensation must have a valid Preparer Tax Identification Number (PTIN) from the IRS. The PTIN is an identifying number for a specific tax preparer on returns prepared. […]

Expressing Our Thanks this Thanksgiving

Thanksgiving is a time for family, comfort food, and feeling thankful for the things we have and the people we love. Here at The Income Tax School we are thankful for our students, our amazing instructors, our hard working employees, our many partners, and the great organizations we are involved with. Here’s what some of our […]

6 Reasons Why Education on IRS Tax Code Is Essential

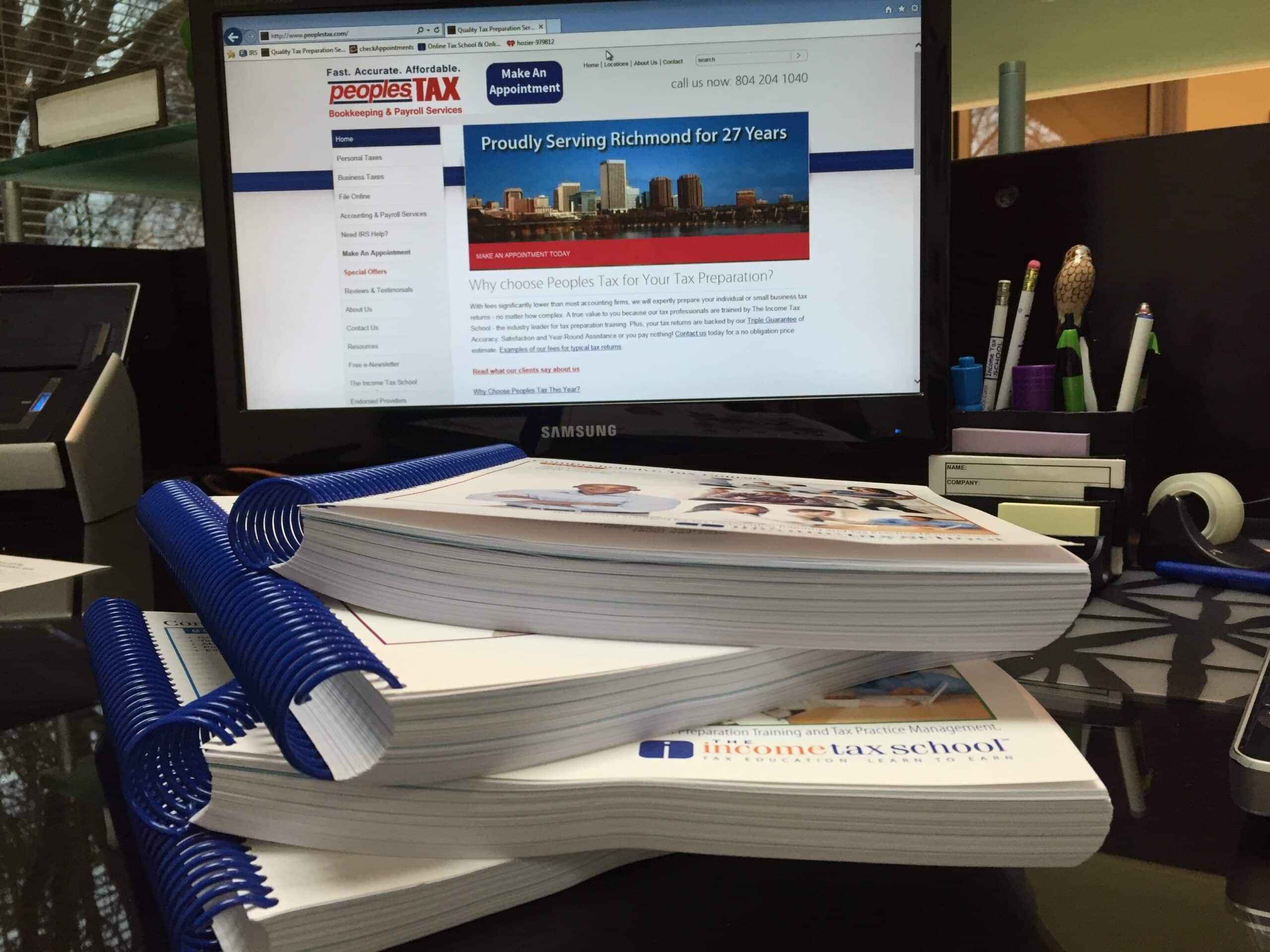

Relying on tax software is a slippery slope – one that tax preparers should not fall for. Sure it’s convenient, but nothing can replace a deep knowledge of tax law. The tax law is extremely complicated and there is a lot to know. So much so that the stack of books to the right are […]

5 Ways to Increase Conversions on Your Website

Your website is a major marketing tool that, if set-up properly can produce calls, walk-ins, appointments, newsletter sign-ups, or really anything your business needs. Setting up a website is one thing. Getting it to convert visitors into clients or newsletter subscribers is something else. So what, specifically, is a website conversion? A conversion rate equals the […]