In less than one week, Americans will vote for our next President. While we won’t make a political endorsement or take a stance on any candidate running, we think it’s important to know the tax plans of both candidates and more importantly, to inform your clients about them. If you are unsure how to communicate this […]

Displaying: Income Tax School

The Many Advantages of Learning Tax Preparation Online

As an eLearning provider, we get a lot of questions about online education and how it compares to time in a classroom. In our connected world, where we spend hours a day online doing everything from shopping to banking, eLearning is just another great way to get the education you need at your own pace […]

A Dozen Tips to Prepare for Tax Season

Are you gearing up for tax season yet? You should be! There’s a lot to do in preparation and the holiday season can sometimes get the best of us. Here are a dozen tips to help you prepare for tax season. 1. Tax Office Policy & Procedure Manual Developing a detailed P&P Manual […]

Get More Done During Tax Season with Technology

Staying on the cutting edge is important. It lets your clients know you’re paying attention to current trends and it helps you get more done! In preparation for tax season, we’ve rounded up these great technology tools that may help you stay organized and get more done. Project Management Software Getting your business ready for […]

The Private Tax Collectors are Coming

The U.S. Treasury is taking measures to collect on the over $400 billion dollars worth of tax bills out there. To do this, Congress has passed a section of the Fixing America’s Surface Transportation (or FAST) Act that instructs the IRS to use private debt collectors to chase down delinquent tax debts. With all of the warnings we’ve […]

IRS Tax Forum Recap

It has been a busy couple of months for the team at The Income Tax School! We’ve been on the road to exhibit and attend IRS Tax Forums across the country! From Chicago to New Orleans, to Maryland, Orlando, and San Diego our team has been to all of the IRS Tax Forums to spread […]

9 Fall Marketing Ideas to Prepare for Tax Season

If you run a tax business, there are always things to do year round to prepare for the current, next or upcoming tax season. Taxes are a seasonal business but as a business owner, you should always be in building and planning mode. Now that’s it’s fall, tax season is right around the corner. Here […]

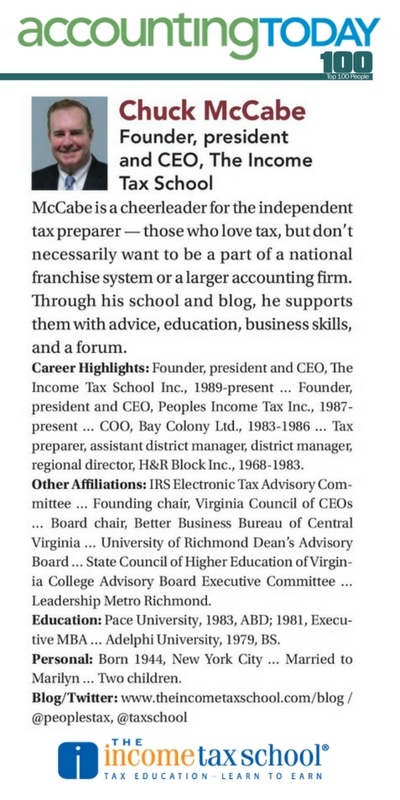

Accounting Today’s 2016 Top 100 Most Influential People in Accounting

I am excited and honored to announce that I have been named among Accounting Today’s 2016 Top 100 Most Influential People in Accounting. Each year, Accounting Today names the top 100 “thought leaders, visionaries, regulators, and others who are shaping the profession.” This is the 4th year I’ve been included in this prestigious list. Below is the […]

Everyone Can Benefit From Going Back to School

The kids are about to go back to school, why not join them? No, you can’t go to school with your kids, but you can further your education and grow as a tax preparer. Expanding on your tax knowledge is beneficial to your clients, yourself, and your business if you are a business owner. Here are […]