Chances are, if you are reading this blog you are either a tax preparer who has taken continuing education courses, a tax preparer who has just completed their tax education, or a tax student. Either way, it’s tax time, and the question you are likely wondering is whether your tax education is deductible. While tax […]

Displaying: Income Tax School

Are You Putting Your Marketing Dollars In The Right Places?

When I think about all of the avenues of advertising a business has to choose from, two quotes come to mind. “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” – John Wanamaker “A man who stops advertising to save money, is like a man who stops a […]

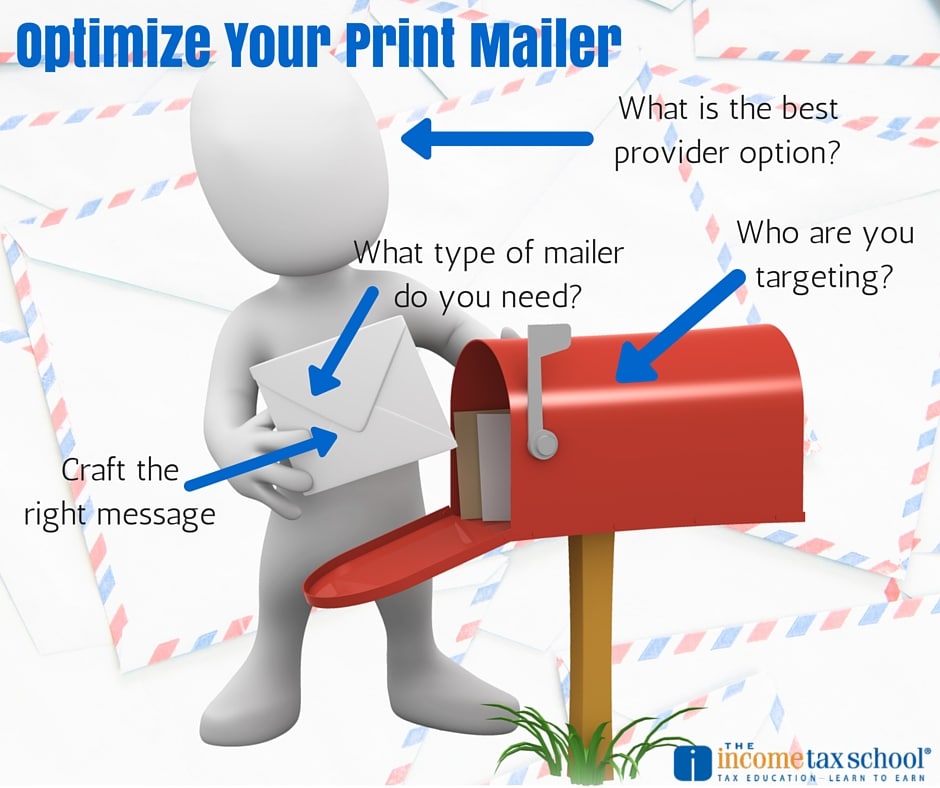

4 Ways to Optimize Your Print Mailers This Tax Season

Thanks to email and the Internet, tax businesses in general do a lot less print mail than they used to. Even so, print mail is making a bit of a comeback and many tax firms still use it to drive business during tax season. People get so many emails these days and many go straight to junk […]

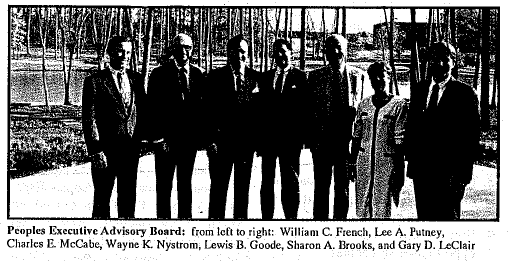

Grow Your Company With An Advisory Board

“No man is an island; entire of himself…” This famous line written in 1624 by English poet John Donne is still sage advice for anyone, especially an entrepreneur. If you’re satisfied being an independent contractor compensated directly in proportion to your personal services rendered, you won’t need a board. But if you want to build […]

Don’t Miss This Crucial Step In Gaining Your Record Of Completion

If you’re currently trying to gain your IRS Record of Completion, the IRS wants to make sure you don’t miss a step. Have you completed the requirements of the AFTR program? Did you completed the required continuing education by Dec. 31, 2015? Have you renewed your PTIN? How about signed the Circular 2030 consent? According to a […]

What’s In Store For The 2016 Tax Season? Get The Scoop

What’s in store for the 2016 tax season? While we don’t have a crystal ball that sees into the future, we have been following IRS updates, tax industry news, and other sources that can paint a pretty good picture of what tax professionals will face this tax season. Here are some things to expect. The […]

5 New Year’s Resolutions To Make Your Tax Season The Best One Yet

It’s almost that time… No not the new year, tax time! Hopefully you’ve all had a restful, relaxing holiday season and are ready for the start of the tax season. Don’t leave your New Year’s resolutions to personal growth, make some for professional growth as well! Here are some resolutions (more like action items) to […]

An Easy, Low-Cost Fast-Track to Entrepreneurship

Are you a people person? Do you aim to please? Do you find that you excel at customer service? If you answered yes to any of those questions, then you’re qualified to become a tax preparer. Tax preparation isn’t all about numbers – it’s about helping people during tax time. As a tax preparer, you […]

Is Tax Education Deductible?

Tax season is right around the corner, and if you’re a tax student you’re likely wondering whether or not your education is going to be deductible. We get this question a lot so we thought we’d address it in a blog post! For students who attend a University, education credits or tuition and fees deductions […]