Paying your taxes just got a little more convenient thanks to a new partnership with the IRS, ACI Worldwide’s OfficialPayments.com the PayNearMe Company, and 7-Eleven. Yep, 7-Eleven. Taxpayers can now fill up, grab a Slurpee and pay the IRS at one of 7,000 7-Eleven locations in 34 states. How convenient! The IRS is trying to make paying […]

Displaying: Income Tax School

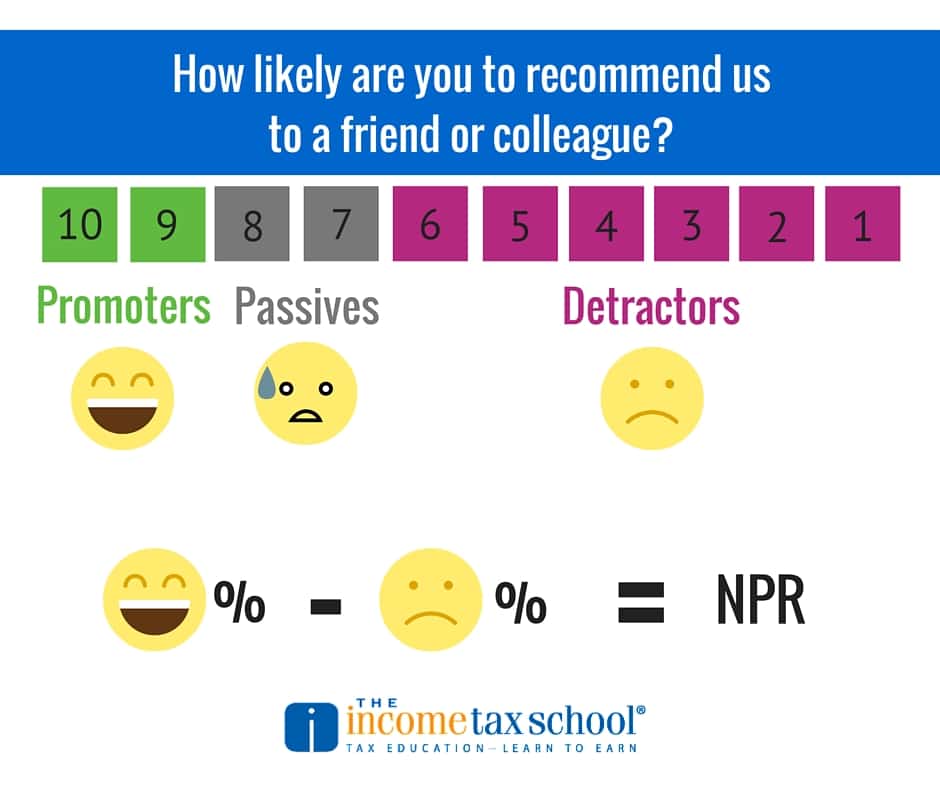

The One Score You Need to Grow Your Tax Business

As a business owner it’s important to track the growth of your company. You can look at revenue, you can look at customer growth, retention and attrition, etc. If you really want to know how your business is doing, or predict future growth, you’ve got to know how happy your customers are with the services you provide. […]

How to Determine Your Fees as a Tax Preparer

What are your fees? How do you charge and do you make your schedule of charges public? These are all questions you should be asking if you are a new tax business owner. Here are some things to think about. Charging by the Form vs. by the Hour There are two different ways you can charge […]

Who Checks Your Returns?

The IRS is always advising taxpayers to double check their returns before filing. How about tax preparers? Contrary to popular belief, tax preparers aren’t robots. As we get down to the wire and pressure builds to get taxes filed before the deadline, here are some reasons why you should have a second tax professional double […]

Creating Word of Mouth for Your Tax Business

Getting people to talk about your business when you run a tax or accounting firm is not easy. Sure, if you’ve got a huge marketing budget that allows you to run television ads that promise huge tax savings each year you could make a dent. But what if you’re a small business? Word of Mouth […]

13 Ways to Be More Efficient This Tax Season

Tax season goes down the same way every year: crickets in January, flocks in March and April. As much as we encourage clients to come in early for their tax preparation appointments, the reality is that the number of returns we prepare increases the closer we get to the April 15th deadline. As a tax professional, […]

4 Mid-Season Outreach Promotions to Try

It’s the middle of tax season. Do you have your marketing caps on? Now is about the time that tax season is starting to set in for taxpayers. It’s the perfect opportunity for you to reach out to potential clients, current clients, and contacts to promote your services and provide information on dealing with the […]

Give Your Clients the VIP Treatment

As important as it is to gain new clients, it is just as important to keep the clients you have. In fact, it is cheaper to retain clients than it is to replace unhappy ones with new ones. The best way to retain clients is to provide excellent customer service and to offer incentives to […]

Three Ways To Get Clients Through Your Door This Tax Season

As tax season marches on, how are you reaching new clients? Are you promoting in the all the right places? Do you have an enticing offer to get them to try your business? Here are three ideas to help drive traffic through your door. Offer up Gift Certificates at events and auctions Finding time to […]