A Strategic Business Plan is important to your company’s growth and success. Have you thought of and included all of the essential things needed to make a strong and effective plan? Here are the essentials. Company Mission Your company Mission Statement is a very important part of your organization. Your mission statement is what drives […]

Displaying: Recent Posts

What to Know About Filing Same-Sex Marriage Returns

Thanks to the Supreme Court ruling that state bans on same-sex marriages are unconstitutional, this coming tax year will be the first year that Gay and Lesbian couples can file jointly as married couples. So what does that mean for us as tax preparers with same-sex couples who decide to tie the knot or who […]

FASB issues new pronouncement Simplifying the Measurement of Inventory

The FASB issued ASU No. 2015-11, Inventory (Topic 330), Simplifying the Measurement of Inventory, in July as part of its Simplification Initiative.

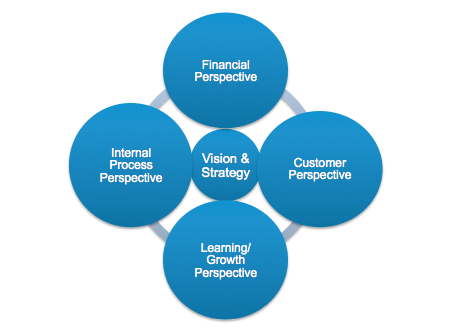

Executing Your Strategic Plan With A Balanced Scorecard

Do you have a strategic plan in place for the growth of your business? If so, good for you! (If not, you might want to check out this blog post). Strategic planning is crucial to growth no matter what industry you are in; but for the tax industry and all of the changes we’ve been […]

Becoming a Tax Business Owner Doesn’t Take Much

Set your own schedule. Make your own rules. Answer only to your clients. Who doesn’t want to be their own boss, right? If you’re getting into, interested in, or are already working in the tax industry, you may be surprised at what little it takes to start your own business as a tax preparer. Getting […]

Adopting A Servant Leadership Model For Your Tax Business

Servant leadership is at the heart of how we do business both at The Income Tax School and at Peoples Tax, our sister company. It’s so important as a business owner that you set strong values for your organization to follow. For us, servant leadership is one of those values. As a business owner, the […]

Study: Accounting leads most profitable industries

According to a new ranking, accounting, tax preparation, bookkeeping and payroll services are collectively the most profitable industry in the nation.

Why Every Tax Business Owner Needs a Strategic Business Plan

Those of us who derive our income from tax preparation continue to face the challenges of fierce competition and seasonality. We know the tax business and how to operate profitably as we’ve always done. But we are now faced with unprecedented threats posed by legislation and technology. These new trends will radically change the […]

5 Must-Take CE Courses for the Upcoming Tax Season

Have you fulfilled your continuing education (CE) requirements yet this year? Here is your reminder to get those CE courses in. If you’re having a hard time choosing the right ones, we’ve got a few suggestions. Tax Law Updates This course is at the top of our list because we feel it is a must. […]