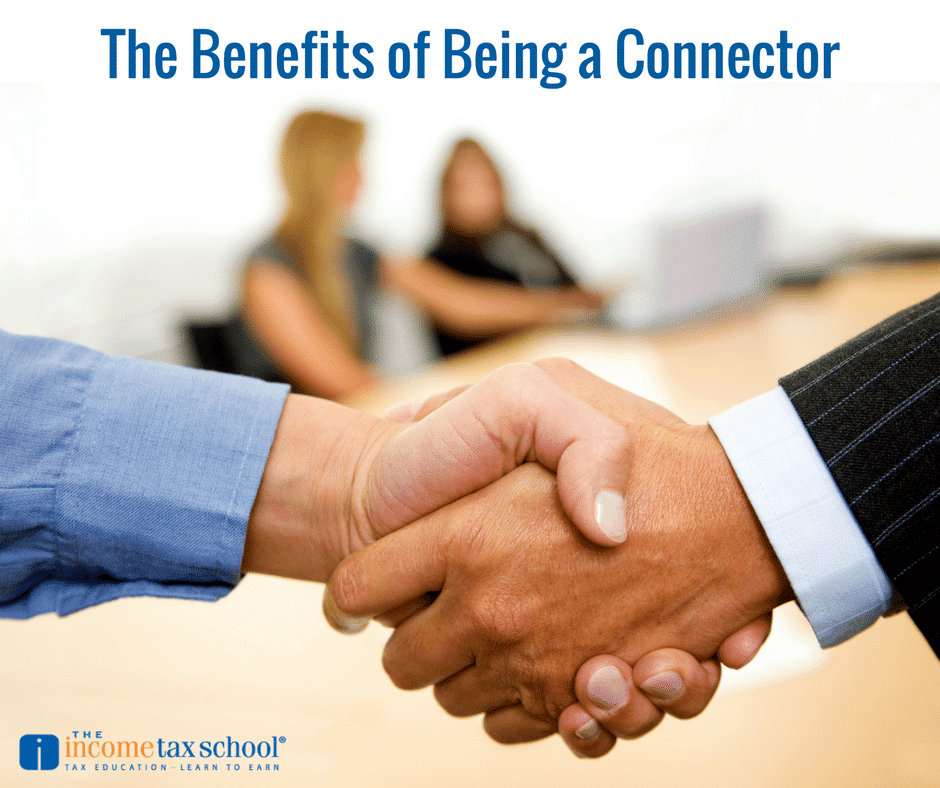

Have you heard of the philosophy “Givers Gain”? It’s a BNI principle based on the law of reciprocity. Networking should be an important part of your business. It’s a tried and true way to build your network, spread the word about your company, and essentially gain new clients. You’ve likely encountered a number of different […]

Displaying: Income Tax School

IRS Tips for Holiday Security

The IRS wants to remind holiday shoppers to remain vigilant with their personal information this holiday season. That means you should be communicating with clients to ensure they stay vigilant this December. In the hustle and bustle of finding the best deals and shopping for everyone on your list, cybercriminals are waiting. While you’re shopping […]

Thankful for Our Family Business

The Income Tax School is a nationwide online tax school that serves thousands of tax professionals and students each year. While that takes an entire team of employees to run, at its core both The Income Tax School and Peoples Tax are a family business. It didn’t start out as a family business, but […]

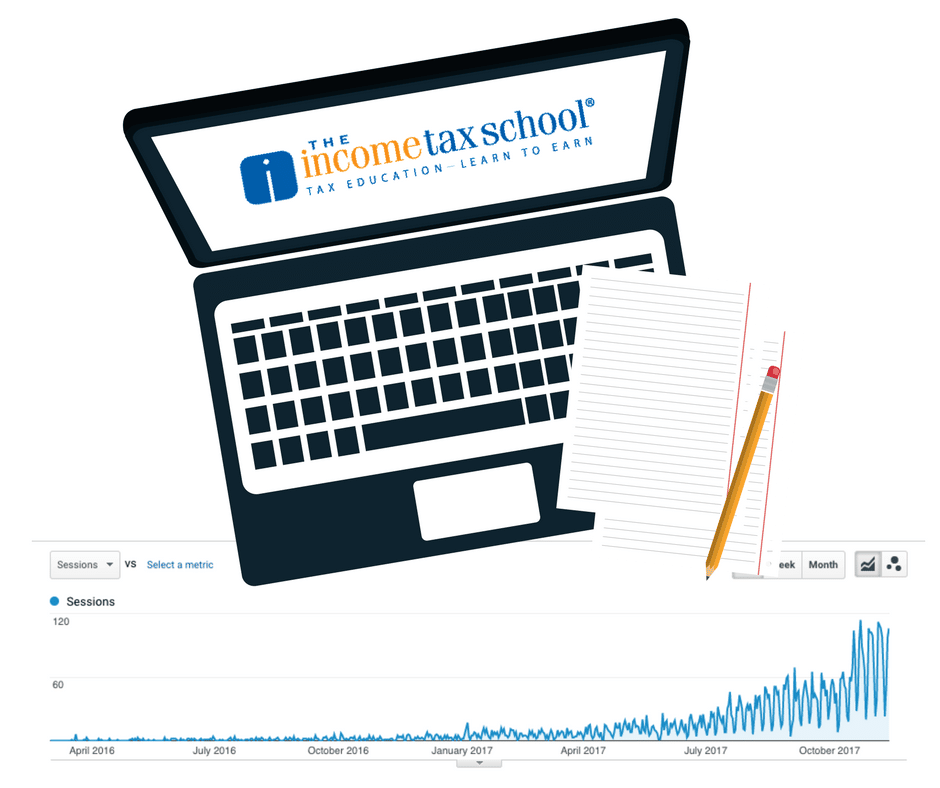

How One Blog Post Generated Thousands of Hits

Last year we wrote a blog post on the Peoples Tax blog (our sister tax preparation company) with line by line explanations on filling out a W4. Each month, no matter what we write about, this blog is the most visited page on our website. In fact, since we posted it in March of […]

Are You Investing In Your Employees?

Your employees are the heart and soul of your business. They keep your clients happy and they keep operations running. It’s important to make sure that you take care of them. Not only do happy employees make for happy clients, it’s expensive to hire and train. So, keeping your turnover low is extremely advantageous. Here […]

Time to Set Year-End Tax Planning Appointments

The holidays are quickly approaching – which for the tax industry means year-end tax planning should be on your radar. Have you reached out to clients yet? It’s important that both individual and business clients consult with you to make tax moves that could positively affect their tax bill come tax season. Here are some […]

Tax Preparers Beware: Cybercriminals Are Out to Get You

Cybercriminals are targeting a new group lately: tax preparers. Cybercrime has become serious business in the past few years as new, more sophisticated scams crop up. Cybercriminals have realized – why target one tax payer when you can breach an entire tax office or single tax preparer and hundreds of taxpayer identities? Be wary of […]

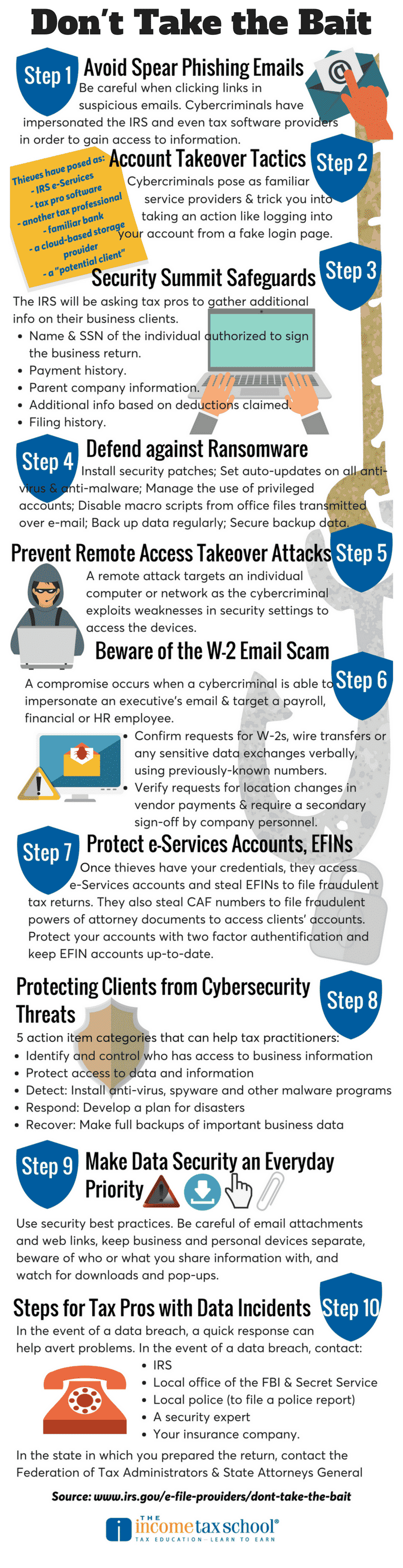

IRS Don’t Take the Bait Recap

Have you been following the IRS Don’t Take the Bait series? This 10-part education series was part of the IRS Security Summit effort. Data breaches and scams have been steadily increasing and are getting more and more sophisticated. The purpose of the series is to raise awareness of this and educate tax preparers on security […]

IRS Nationwide Tax Forum Recap

Our team had such a great time this year attending the IRS Nationwide Tax Forums! We were in Orlando, Las Vegas, Dallas, National Harbor, and San Diego meeting with tax preparers and talking about tax education. We love meeting new people, answering questions, and reconnecting with our “Road Family” – people we see year after […]