Displaying: Income Tax School

Free Resources for Tax Preparers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders. That’s why, along with all of the materials and support we provide to students, we also strive to write informational blog posts and other free sources of information. Did you know […]

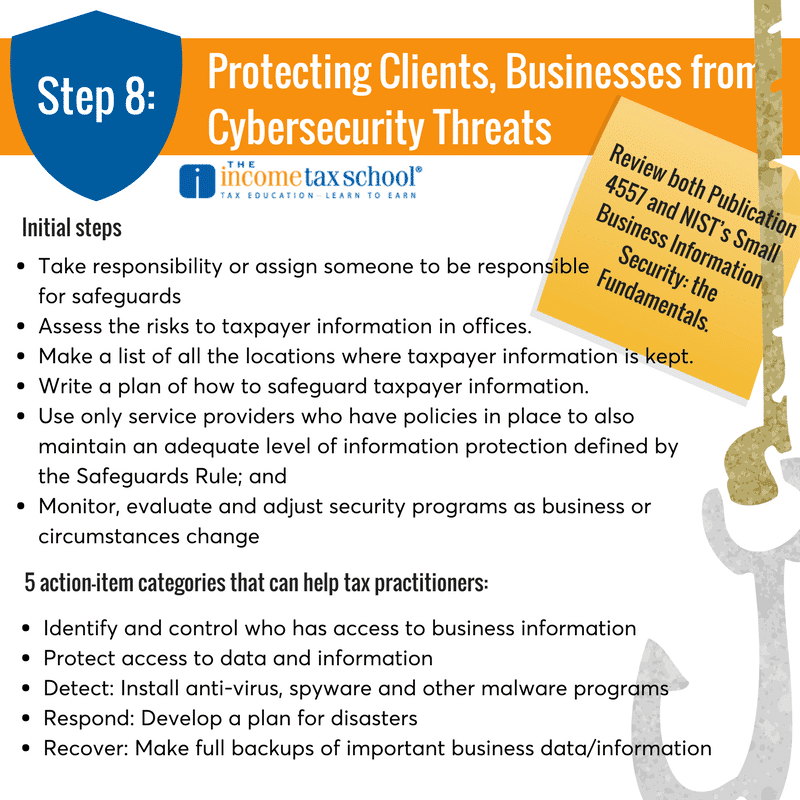

Protect Your Clients From Cybersecurity Threats

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to do so through their Don’t Take the Bait campaign, a 1o part series […]

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could […]

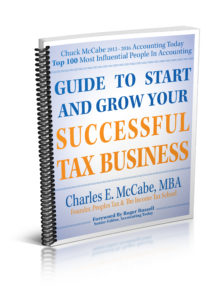

Introducing: Guide to Start and Grow Your Successful Tax Business

I’m excited to announce the release of my book, Guide to Start and Grow Your Successful Tax Business! This 289-page book is a go-to guide for anyone looking to start or grow a tax business. The guide covers everything from learning tax preparation, to establishing your tax office, marketing and pricing, recruiting and training employees, […]

The Benefits of Guest Blogging for Your Tax Business

Content marketing has become an important part of marketing for every business. Beyond sharing your expertise on your blog or creating white papers for download, there’s another great option – that could help get you in front of fresh eyeballs. It’s called guest blogging. Guest blogging is just what it sounds like. Creating original content […]

New Guidelines on Passwords

You know all that advice about making hard passwords? They must include at least one number and special character. You know how we’re told to change the password frequently and to never use the same one for different things? Well, there are new guidelines that basically say to forget what you’ve been told. So, thanks […]

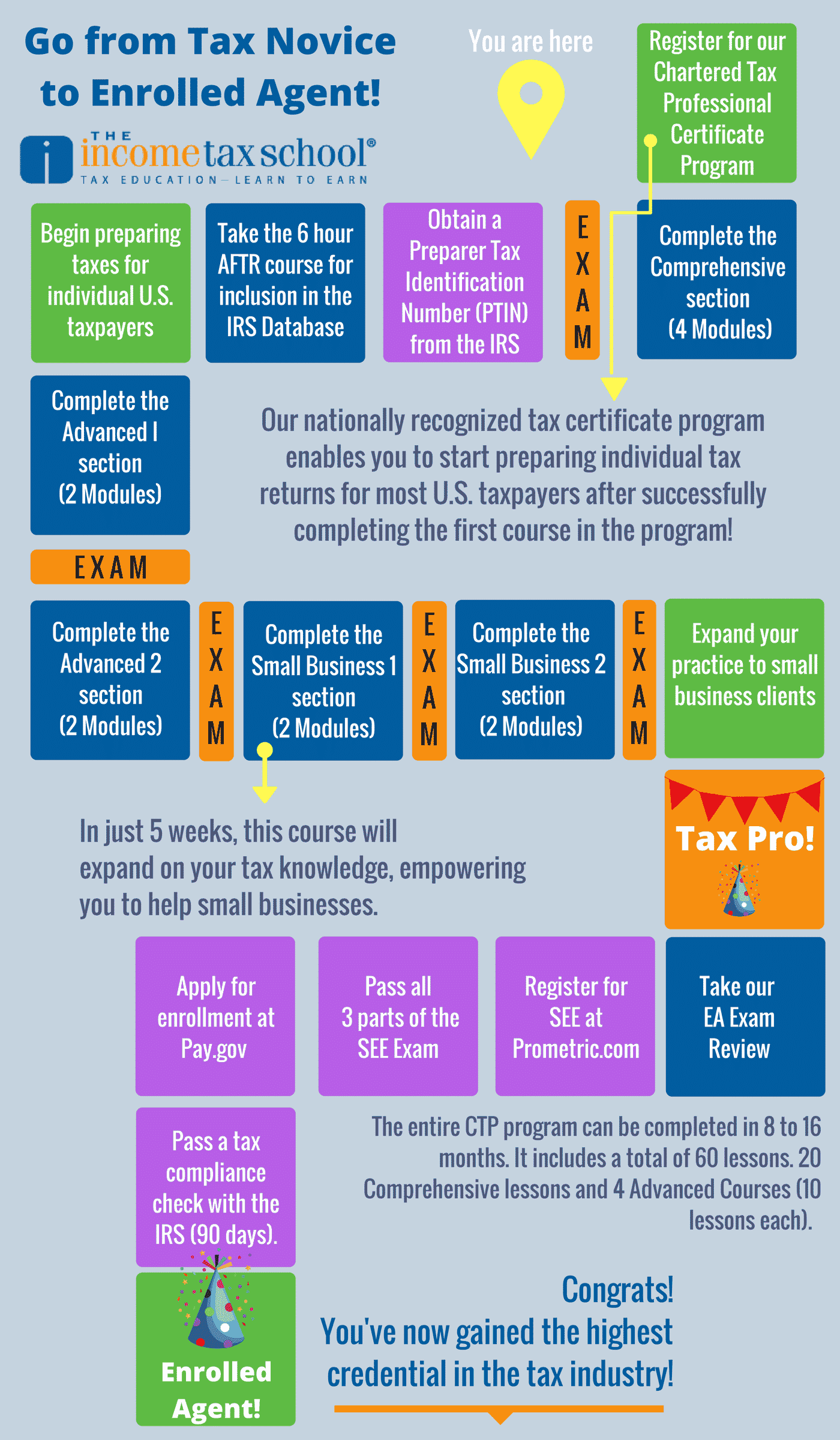

The Path to Enrolled Agent

If you’re looking for a career in the tax industry, set your sights high! While it doesn’t take much to become a tax preparer and start preparing taxes for the general public, earning a credential as an Enrolled Agent should be the ultimate goal. Enrolled Agents are the only credentialed tax preparer and thus have […]

Online Directories: A Great Way to Boost Your SEO

When you type in “tax preparer in [enter your city]”, does your firm come up? Is it at the top of search results? There are a lot of things that factor into being on the first page of Google. Are you employing SEO tactics? Do you have a lot of competition? Is your site optimized […]