AI is the hot technology term these days. It seems to be “disrupting” just about every industry you can think of – including the tax industry. This past tax season, H&R Block partnered with IBM Watson to use its powerful AI capabilities in 10,000 of its U.S. offices. The initial focus of the technology was […]

Displaying: Income Tax School

Expand Your Social Media Arsenal This Summer

Facebook, Twitter, LinkedIn… these are the three standard channels we all think of when it comes to social media marketing. But they aren’t the only ones. There’s also Instagram, Snapchat, YouTube and Pinterest (to name a few). Social media has a major force in marketing and communications – one that tax preparers should not be […]

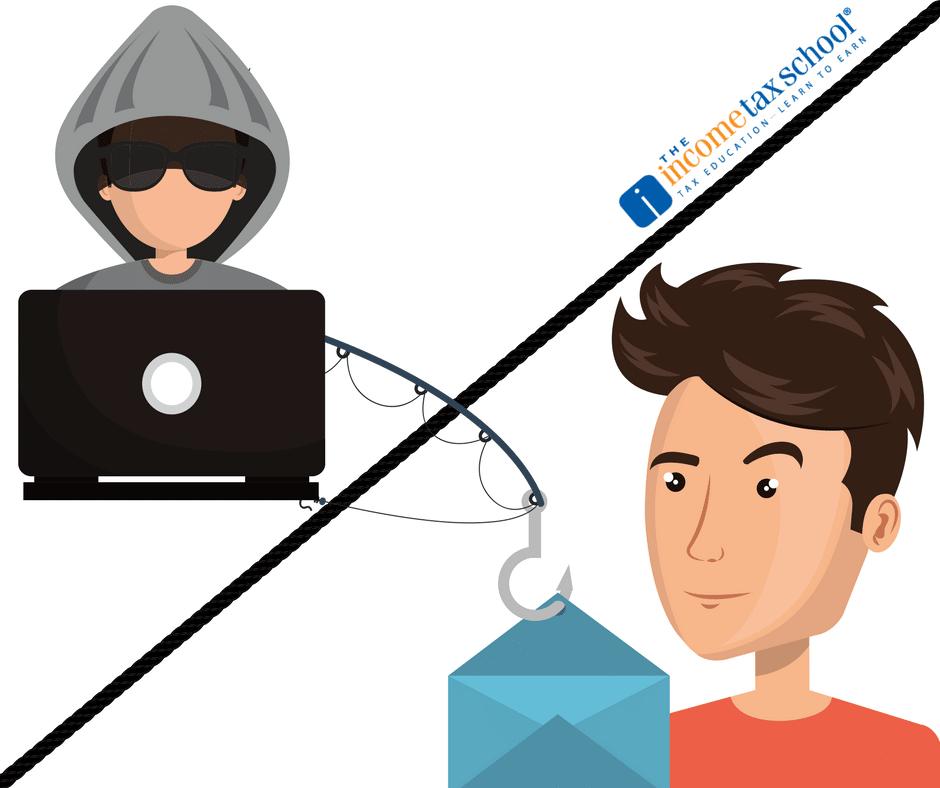

IRS Launches New Educational Series on Cybercrime

We’ve been talking a lot about phishing scams and tax fraud lately. It’s a very serious problem that has lots of people in the industry talking – including the IRS. Cybercriminals have become increasingly sophisticated, which means taxpayers and tax professionals need to become more educated about how these scams work. We talked about this […]

Becoming a Tax Business Owner is Easier than You Might Imagine!

Set your own schedule. Make your own rules. Answer only to your clients. Who doesn’t want to be their own boss, right? If you’re getting into, interested in, or are already working in the tax industry, you may be surprised at what little it takes to start your own business as a tax preparer. Getting […]

The Common Denominator In Most Tax Scams

There’s a new tax scam on the rise that is being reported across the country. Fraudsters are getting extremely creative and will stop at nothing to fool the public into getting what they want: your money. In these new scams, criminals are calling taxpayers over the phone and demanding they make an immediate payment via […]

Why You Should Attend the 2017 IRS Tax Forums

The 2017 IRS Tax Forums are approaching. Have you registered for one yet? Dates/locations include: Orlando, FL: July 11-13 Dallas, TX: July 25-27 National Harbor, MD: August 22-24 Las Vegas, NV: August 29-31 San Diego, CA: September 12-14 As you may already know, attending the IRS Tax Forums provides you with the opportunity to earn […]

6 Reasons to Operate Your Own Tax School in the Off-Season

Are you making the most of the off season? Trying to think of ways that you can? Beyond offering additional services, you could also run your own tax school. We’ve found it to be a great business model. In fact, it’s how The Income Tax School got started! Here are six reasons to operate your […]

4 Stories Every Tax Preparer Should Be Paying Attention To

There’s been a bit of a shake up in the tax industry the past couple of weeks! Lots of changes are being made (or trying to be made) that could have serious impacts on our roles as tax preparers and tax business owners. Here are 4 stories you should be aware of and following closely. PTIN Fees […]

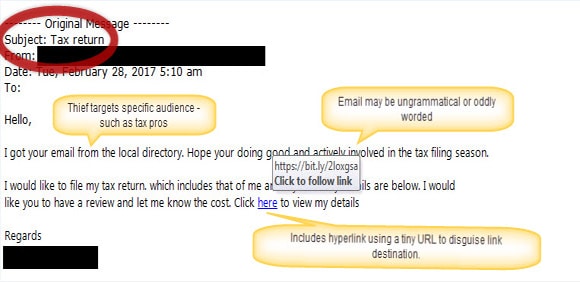

Would You Take the Bait? Why Phishing Scams Should Concern You

Who really falls for a phishing scam? It’s probably a question you’ve asked yourself or said to a friend or colleague. People fall for phishing scams all the time, it’s why they continue to happen. Sure, there are a lot of “Nigerian Prince” emails that get sent. These are the most obvious and well known […]