This Summer is a great time to evaluate the tax season and make a plan for next season. Beyond staffing and process improvements you should be looking at the services you offer and what you plan to offer or focus on next season. We’ve been watching the industry and the news closely and have 4 reasons why […]

Displaying: Income Tax School

Why You Should Recruit and Train Tax Preparers in House

Is your tax business growing? Did you have tax preparers leave or retire after the season? Could you use some help next tax season? If you answered yes to any of these you’re probably looking to hire tax preparers next season. Before you put the word out that you’re hiring “experienced tax preparers” read this blog […]

5 Ways to Seize the Summer and Make More Money Next Tax Season

Tax season might be over and summer/vacation time may be in full swing, but here’s something to keep in the back of you mind: there are about 257 days until the start of next season. So why not Carpe Diem – or better yet seize the summer to ensure you are spending the off-season making […]

Why Peer Groups Are Important In Business

This past weekend I was recognized by the Virginia Council of CEOs. The Council announced the establishment of an annual VACEOs “Charles E. McCabe Leadership Award” in my name and made me the first recipient. The award recognizes those who make significant leadership contributions to the Council, and I am extremely honored to both have […]

Evaluating Tax Season

You made it! Tax season is over! While clients may not be piling through the door to have their tax returns filed, there’s still work to be done. Evaluating your season and planning for next season is an important task to tackle right now while everything is fresh. Before you pack that suitcase and head off […]

What to Tell Your Clients Who Are Late to the Filing Party

It’s late filing season and there are roughly 40 million taxpayers that have yet to file their taxes. Are some of your clients included in that number? Here are some things to communicate to clients regarding extensions. Automatic Extensions There are some taxpayers in special situations that qualify for automatic extensions. That’s right, they don’t even have […]

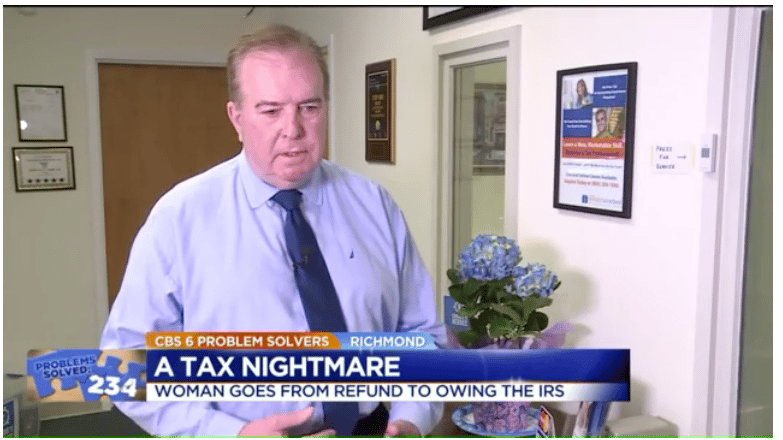

Are You Conducting Thorough Tax Interviews?

I was recently interviewed by CBS 6 News about finding the right tax preparer. The story began with a woman who received a refund anticipation loan after being told she would be getting a refund. Turns out she actually owed taxes, and the preparer needed to file an amendment. Her tax preparer, who didn’t want […]

Boost the Morale in Your Office for Laugh at Work Week

It may be all hands on deck as we finish out the tax season but it’s important to make sure you keep up the morale in the office. This week is Laugh at Work Week, the perfect time to have some fun. Laughter and humor are an important part of the workplace. Laughter has been […]

7 Ways to Show Appreciation to Employees (and Clients) During Tax Season

Clients and employees are essential to your business. Your employees keep your business running and your clients keep you in business. Showing a little appreciation for them is of utmost importance. Employees who feel appreciated are happier. And happy employees can have a huge effect on your company culture and your bottom line. According to […]