We talk a lot about making a career as a tax preparer because we’re so passionate about seeing people go from tax student to successful tax preparer – or self-employed tax business owner. But tax preparation doesn’t have to be a career, it’s also a great way to make money on the side after retirement. Here […]

Displaying: Income Tax School

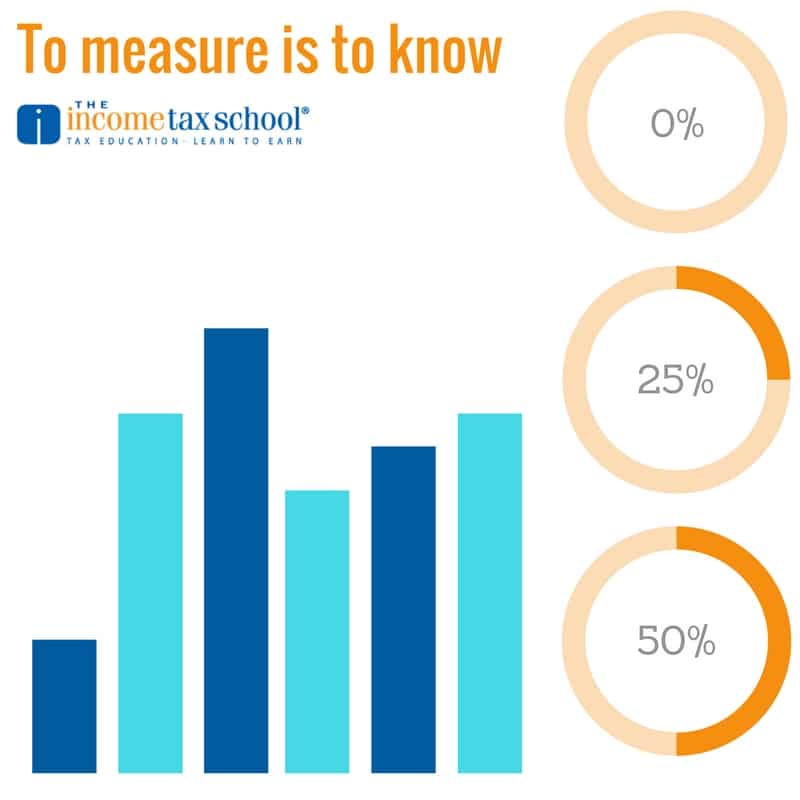

17 Crucial Metrics Every Tax Office Should Be Tracking

Are you going through the motions every tax season? If you’re not tracking the right metrics and making improvements to grow your business each year then yes, you are just going through the motions. Looking at your bottom line is important, but your bottom line is only going to tell you whether or not you […]

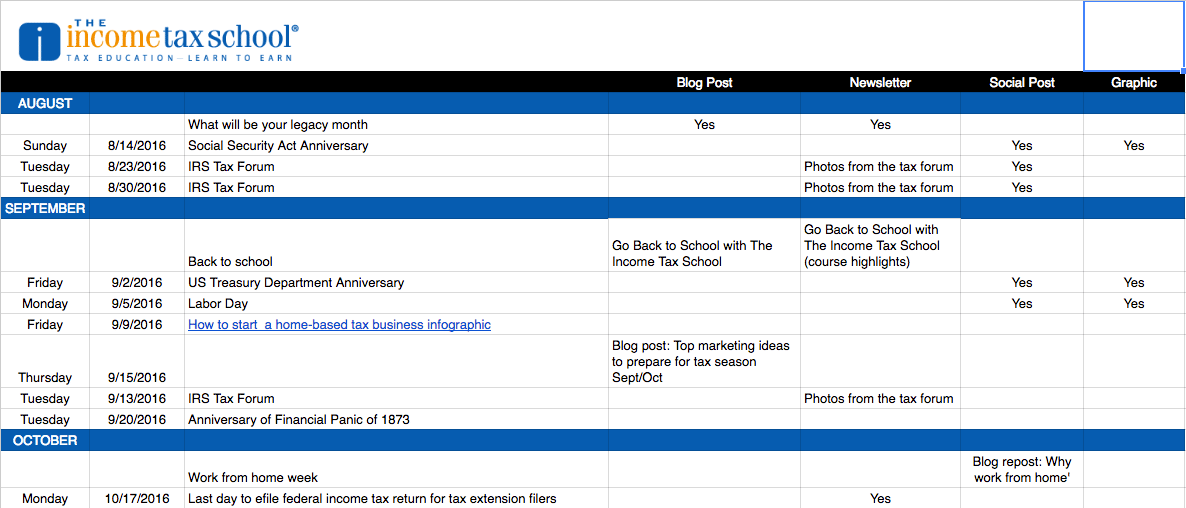

5 Essentials to Developing a Client Newsletter

Email newsletters are a great way to keep in touch with clients year-round. They add a personal touch, keep clients in the loop, and are sharable. We’ve discussed their importance before, but have yet to go into developing a solid newsletter. We got a great question on a recent blog post (5 Marketing Things to do […]

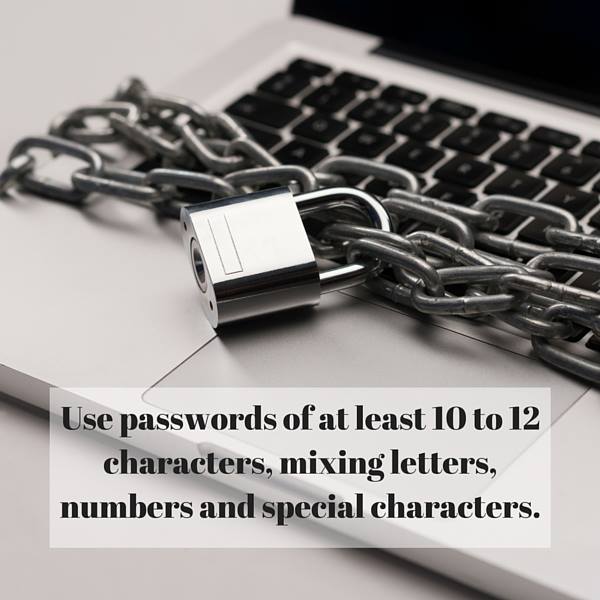

How to Protect Your Clients’ Information

As a tax preparer, you are privy to a lot of confidential information – information that could do your clients severe harm if it ended up in the wrong hands. This year, the IRS has been making a lot of changes to their processes to help guard taxpayers against the growing number of individuals who commit […]

How to Start a Home Based Tax Business

Have you thought about what it would be like to be your own boss? There’s a lot of freedom that comes with entrepreneurship but for some, the challenge is finding a lucrative field in which to pursue business ownership. As long as there are taxes, there will be a need for tax preparers. The tax business […]

What is the fate of IRS Commissioner Koskinen?

House Conservatives are trying to force a vote to impeach IRS Commissioner John Koskinen. Action on the motion – if the motion for a vote to impeach is passed – could be delayed until September. Today we find out whether that vote will actually happen. The last time Congress impeached an appointed administration official was […]

Are you Your Client’s Best Advocate?

Tax preparers have a very important role in the lives of their client’s: the role of trusted advisor in matters of tax. Tax preparers are trusted with information that is very personal to their client’s: their finances. This trust is not something to take lightly. You are an advocate… …when it comes to tax returns. […]

Top ways to grow your new home-based tax business

Starting a home-based tax business can be very rewarding once you have the tax education under your belt. Aside from preparing taxes for family, how do you build your business with essentially no marketing budget and no storefront? In this blog we’ll lay out some of the top ways to grow your home-based business using […]

Tax Scam Round-up: Know What You’re Up Against

Step aside tax evaders, the IRS has a new criminal in their crosshairs: tax scammers and identity thieves. Don’t think it will happen to you or your clients – or to you? Think again. As of this March 2016, the IRS reported identifying 42,148 tax returns with $227 million claimed in fraudulent refunds and prevented the […]