Ready to start your tax business for the new tax season but wondering how much to charge? It can be difficult to price your own services. If you’ve done any market research you’ve likely discovered that the cost of preparing any tax return can vary dramatically among different tax practitioners. Many tax preparers charge by […]

Displaying: Recent Posts

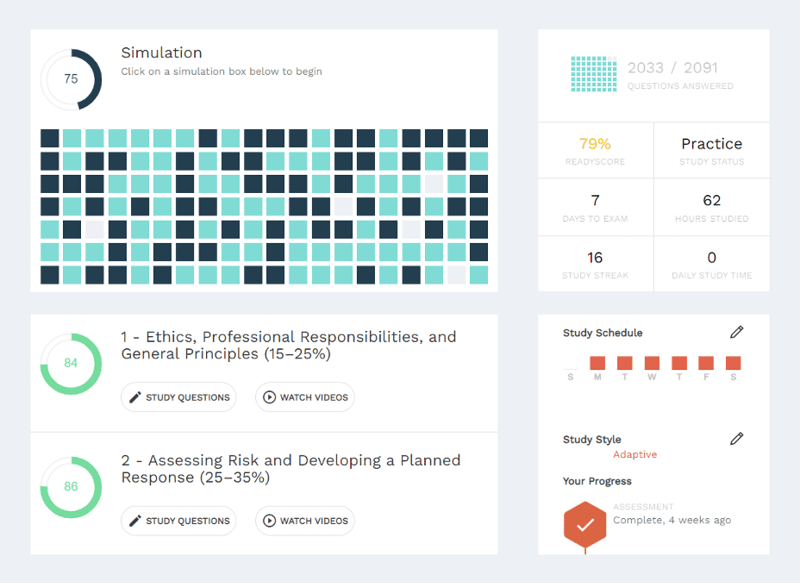

The best CMA study materials and their use cases

The Certified Management Account Exam (CMA Exam) has several exam prep options at your fingertips, each involving different study materials and techniques. Your primary choices include: This comparison will help you evaluate your options, see why you should consider an adaptive course and examine the use cases for other study materials. Study option 1: courses […]

Marketing strategies to prepare your business for tax season

When it comes to taxes, 2022 was a crazy year. That’s why it’s so important to start prepping for 2023 now to ensure you get the most business out of the season. Taxpayers continue to focus on digital solutions, and there are numerous ways you can optimize your online and physical presence to capitalize on […]

Best practices for answering the phone at your tax business

When a client has an issue or wants to learn more about the services you provide, all the digital tools in the world cannot replace speaking to a real person. It doesn’t matter how comprehensive your website is or how advanced your automated operator is, you will need a team ready and able to answer […]

The different jobs you can get with an EA credential

There are dozens of factors that go into job satisfaction, not just the work you’re performing. You should also consider factors like: Being an enrolled agent offers solid career benefits: there are hundreds of options, and there is no one-size-fits-all career path. To help you find the perfect career as an enrolled agent, we’ve put together a list […]

How to study for the Enrolled Agent Exam

The Enrolled Agent Exam (also called the IRS Special Enrollment Examination) is a 3-part process requiring careful preparation. While some exam stress is natural, it doesn’t have to feel completely overwhelming. Do any of these sound like you? Fear not – you can find study materials that match your learning style and make good use […]

What’s the difference between CPA certificate and CPA license?

CPA license. CPA certificate. Here’s the question that’s probably on your mind: Which is more useful? Don’t make the mistake of believing that “license” and “certificate” are similar. CPA certification and CPA licensure are very different. Certification comes first, from simply meeting the requirements for and passing the CPA Exam. Licensure means passing the exam […]

Get a boost with CPA Review’s visual learning features

Every CPA review course tends to advertise the same selling points – smart/adaptive learning technology, coaching, video content, textbooks and flashcards… the list goes on. Rather than comparing prices and basic features, try finding a course that matches your learning style. Ultimately, finding a course that helps you process information the best can help […]

How to make money year-round as a tax preparer

For many new tax preparers – and those who have considered entering the field – one of the main concerns is how they can make money year-round from a job that’s typically seasonal work. Let’s take a look at what options you have as a tax preparer if you’re looking to earn more income and […]