On April 14, 2016, the Financial Accounting Standards Board (FASB) released Accounting Standards Update No. 2016-10, Revenue from Contracts with Customers Topic 606.

Displaying: Recent Posts

New DRS question type now available in Surgent CPA Review

As recently announced by the AICPA, a new simulation question type, the Document Review Simulation (DRS), will debut on the CPA Exam on July 1, 2016. This new question type will appear in the FAR, AUD and REG sections initially and move to the BEC section in 2017.

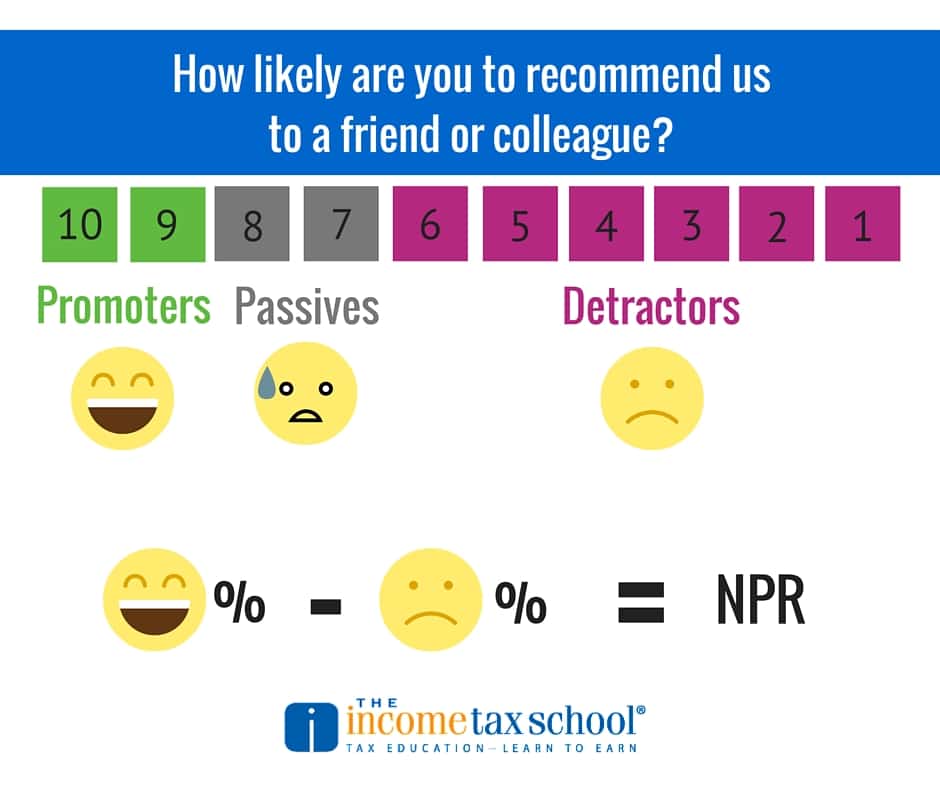

The One Score You Need to Grow Your Tax Business

As a business owner it’s important to track the growth of your company. You can look at revenue, you can look at customer growth, retention and attrition, etc. If you really want to know how your business is doing, or predict future growth, you’ve got to know how happy your customers are with the services you provide. […]

ASB issues Clarification and Recodification of Attestation Standards for 2017

The Auditing Standards Board (ASB) issued Statement on Standards for Attestation Engagements (SSAE) No. 18, Attestation Standards: Clarification and Recodification.

AICPA announces final changes to the 2017 CPA Exam

The next version will launch April 1, 2017. Each section of the test will now be four hours in length, for a total testing time of 16 hours. Get the latest CPA Review info.

How to Determine Your Fees as a Tax Preparer

What are your fees? How do you charge and do you make your schedule of charges public? These are all questions you should be asking if you are a new tax business owner. Here are some things to think about. Charging by the Form vs. by the Hour There are two different ways you can charge […]

Who Checks Your Returns?

The IRS is always advising taxpayers to double check their returns before filing. How about tax preparers? Contrary to popular belief, tax preparers aren’t robots. As we get down to the wire and pressure builds to get taxes filed before the deadline, here are some reasons why you should have a second tax professional double […]

ASU 2016-08 Revenue updates

On March 17, 2016, the FASB (Financial Accounting Standards Board) issued Accounting Standards Update No. 2016-08, Revenue from Contracts with Customers (Topic 606).

Creating Word of Mouth for Your Tax Business

Getting people to talk about your business when you run a tax or accounting firm is not easy. Sure, if you’ve got a huge marketing budget that allows you to run television ads that promise huge tax savings each year you could make a dent. But what if you’re a small business? Word of Mouth […]